Orthodox macroeconomic policies are having desired effects, with the exchange rate and the central bank’s stock of reserves stabilizing even as import restrictions have been lifted. Higher interest rates have had a dampening effect on economic activities, but very strong remittances have supported household consumption, while exports and public demand also contributed to growth. The economic recovery had started by summer, though pockets of weakness remain, particularly in private investment consumption.

Real GDP grew by 4.9 percent through the year to the March quarter -- continuing a modest pick up after general slowdown since 2022-23 (Chart 1). The disruptions to economic activity in the September quarter are behind us, but the economy is still around 3 percent or so smaller than would have been the case had the pre-pandemic growth rates continued.

Economic activities

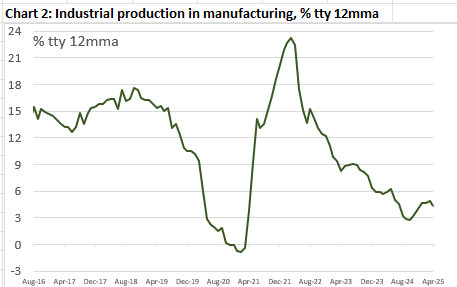

Industrial production is a strong correlate of real GDP growth. The series grew by over 4 percent in the year ending in April 2025, a modest pick-up from the 3 percent in the year to last monsoon, but much slower than the 15 percent clip recorded before the pandemic, corroborating the general economic weakness.

International trade data corroborate the economic recovery into the summer.

Exports have staged a recovery since monsoon, growing by 23 percent in the year ending April 2025, much stronger than the pre-pandemic trend (Chart 4). That is, one of the twin engines of the country’s economy has been firing well.

Imports had also started recovering last autumn after various restrictions were lifted, growing by nearly 15 percent in the year to April 2025. However, the recovery in import is more likely to be related to the exports sector than the strength in domestic demand.

Tax revenue, usually a strong correlate of economic activities, provides a bleaker picture. Tax revenue growth has been slowing sharply since last monsoon (Chart 5), partly due to weakness in economic activities but also reflecting cuts in import duties to reduce cost of living.

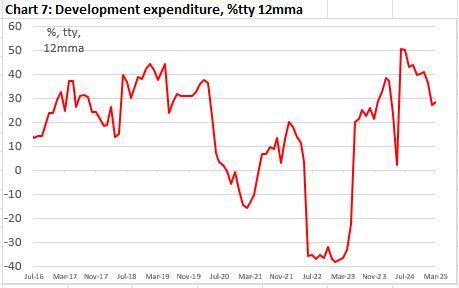

Turning to the other side of the public finance ledger, both non-development and development expenditures grew strongly in the first three quarters of 2024-25 fiscal year (Charts 6 and 7). That is, public demand has likely been contributing to economic growth, notwithstanding the political instability.

The picture is less buoyant for private sector demand.

Growth in credit to the private sector is an oft-used proxy for private investment. This series slowed markedly in winter and was yet to recover into the summer (Chart 8), reflecting the effects of a tighter monetary stance as well as ongoing political uncertainty.

Electricity sale (and generation) is a widely used correlate of economic growth, and confirms the overall picture of a recovery with pockets of weakness (Chart 9).

Prices and Income

The picture is also mixed when one considers indicators of prices and income. The wage rate index continues to grow strongly (Chart 10) and yet has failed to keep pace with inflation (Chart 11), suggesting an erosion of real income. Nonetheless, inflation has finally started to ease, recording a three-year low of 8.5 percent in the year to June 2025.

Rice prices were elevated compared to the pre-pandemic levels in winter, but remained well below the early 2023 peak (Chart 12).

The Khichuri Indicator is a simple measure of the living standard of the urban worker. It shows the number of plates of khichuri -- rice, lentil, oil and salt -- one can buy on the daily wage of a skilled industrial worker. According to the indicator, living standards of the urban worker had barely changed in 2024, and remained well below the pre-pandemic levels (Chart 13).

Against the weakness in many indicators, one factor supporting economic activities has been the large number of Bangladeshis going overseas to work (Chart 14). To the extent that the labour markets in the hosting countries had been strong, the outflow of workers should result in a strong inflow of remittances. And formal remittances have been growing very strongly since last monsoon (Chart 15).

Strong remittance growth has put a floor on domestic consumption growth as well as help stabilize the external sector, allowing the monetary policy to tackle inflationary pressures.

Policy Settings

Draconian import restrictions under the fallen Hasina regime did not prevent the taka from sliding in 2023. Nor did it stem the bleeding of the stock of international reserves held by the Bangladesh Bank. In contrast, orthodox macroeconomic policies since the change in government have stabilized the exchange rate as well reserves. Measured in terms of the months of imports, reserves appear to remain in the "safe zone" of around three months, notwithstanding the recovery in imports.

The effects of the new monetary policy framework is visible in the interest rates (Chart 17), with real borrowing rates remaining nearing its historical norms by the summer.

Meanwhile, public sector borrowing growth has been softening into the summer (Chart 18), helping the central bank manage banking sector difficulties as well as tackle inflation.

First published in the Counterpoint.

Further reading

দ্রব্যমূল্য নিয়ে স্বস্তিতে মানুষ কমেছে অধিকাংশ পণ্যের দাম

সরদার আনিছ, 3 June 2025