Economic disruptions of the Monsoon Revolution are clearly visible in the data, as are some of the aftereffects. Economic activities clearly slowed in the monsoon, and cost of living pressures remained elevated. The interim government has adopted appropriate macroeconomic policies to stabilise the external sector and ease inflation. Meanwhile, the twin engines of growth — exports and remittances — are firing again. On balance, and barring further shocks, the worst of economic doldrums may be behind us.

Real GDP grew by 1.8 percent through the year to the September quarter — slowest year ended pace since the pandemic-induced lockdowns (Chart 1). The economy had been slowing since 2022, with the disruptions to economic activity in the September quarter clearly visible in the data. The sharp slowdown in that quarter occurred across all sectors.

Chart 1 also shows that economic growth more stable before the pandemic. The economy was between 12-15 percent smaller than a hypothetical level that could have been attained if the pre-pandemic growth trend had been maintained, with much of the ‘output gap’ occurring after 2022.

Economic activities

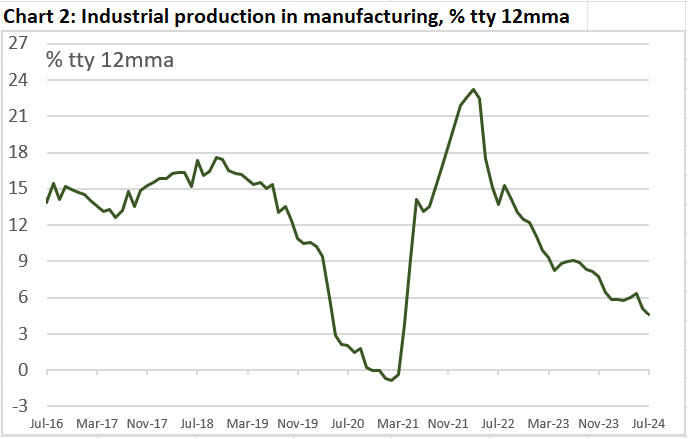

Industrial production is a strong correlate of real GDP growth. This series is usually available on a monthly basis and can help ‘nowcast’ real GDP. Unfortunately, the data is currently available to only July 2024, corroborating the general economic slowdown.

International trade data, however, present a somewhat brighter picture into the autumn.

Exports were declining in year-ended terms in the first half of 2024, but has staged a recovery since monsoon (Chart 4). That is, one of the twin engines of the country’s economy may be kickstarting.

Imports declined in 2023-24 reflecting various restrictions, but has also staged a recovery in the autumn (Chart 4). While imports mechanically detract from GDP, import growth reflects demand in the economy.

That is, on balance, international trade data points to an incipient recovery in late 2024.

Tax revenue is another correlate of economic growth. Tax revenue growth has slowed in the current fiscal year (Chart 5).

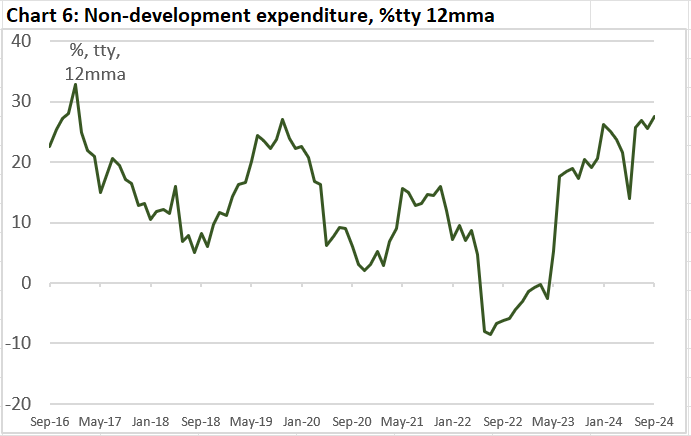

Turning to the other side of the public finance ledger, both non-development and development expenditures grew in the first quarter of 2024-25 fiscal year (Charts 6 and 7). That is, public demand likely to have been contributing to economic growth, notwithstanding the political upheaval.

The picture is mixed for private sector demand.

Growth in credit to the private sector is an oft-used proxy for private investment. This series slowed markedly in late 2024 (Chart 8), reflecting the effects of a tighter monetary stance as well as continuous weakness in the corporate sector.

Electricity sale (and generation) is a widely used correlate of economic growth, with monthly data helping decipher broader economic trends before the national accounts are formally published. However, the series is currently available to only summer of 2024 (Chart 9).

Prices and Income

The picture is also mixed when one considers indicators of prices and income. The wage rate index grew strongly into the winter (Chart 10) and yet have failed to keep pace with inflation (Chart 11), suggesting an erosion of real income.

Rice prices were elevated compared to the pre-pandemic levels during the monsoon, but remained well below the early 2023 peak (Chart 12).

The Khichuri Indicator is a simple measure of the living standard of the urban worker. It shows the number of plates of khichuri — rice, lentil, oil and salt — one can buy on the daily wage of a skilled industrial worker. According to the indicator, living standards of the urban worker had barely changed in 2024, and remained well below the pre-pandemic levels (Chart 13).

Against the weakness in many indicators, one factor boosting the economic outlook is the large number of Bangladeshis going overseas to work (Chart 14). To the extent that the labour markets in the hosting countries are booming, the outflow workers should result in a strong inflow of remittances. And formal remittances have been growing strongly in recent months (Chart 15).

Strong remittance growth should put a floor on domestic consumption growth as well as help stabilize the external sector, allowing the monetary policy to tackle inflationary pressures.

Policy Settings

Draconian import restrictions under the fallen Hasina regime did not prevent the taka from sliding in 2023. Nor did it stem the bleeding of the stock of international reserves held by the Bangladesh Bank. In contrast, orthodox macroeconomic policies of tighter monetary settings and fiscal consolidation have stabilised the exchange rate as well reserves. Measured in terms of the months of imports, reserves appear to remain in the ‘safe zone’ of above three months, notwithstanding the recovery in imports.

The effects of new monetary policy is visible in the interest rates (Chart 17), with real borrowing rates finally becoming positive.

Meanwhile, public sector borrowing growth has been softening into the autumn (Chart 18), helping the central bank manage banking sector difficulties as well as tackle inflation.

Trendspotting was conceived with Netra News during the pandemic as way to gauge the recovery. It had moved to this platform in 2021 and helped track the economy during the latest doldrums. The aim is to eventually formalise these into some form of nowcasting framework.

All data are from Bangladesh Bureau of Statistics or Bangladesh Bank through CEIC Asia database. Series are smoothened by 12 or 3 month moving average. Charts are labelled with the latest period of available data.

Further reading

Will Bangladesh come to regret its dash for gas?

Benjamin Parkin and Harry Dempsey. 29 Oct 2023

ঋণের চাহিদা বাড়ছে, বাড়ছে না অর্থায়নের সুযোগ

ফারিন জাহান সিগমা, 22 Nov 2024

ব্যাংকের ঝুঁকিপূর্ণ সম্পদ ছুঁতে পারে ৮ লাখ কোটি টাকা

শেখ হারুন, 30 Nov 2024

Money trail: questions over deposed Bangladeshi elite’s £400m UK property empire

Rob Davies, Kaamil Ahmed and Redwan Ahmed, 1 Dec 2024

How Bangladesh’s Economy Was Siphoned Dry

Alex Travelli and Shayeza Walid, 4 Dec 2024

What to do with the 10 ‘technically bankrupt’ banks?

Shadique Mahbub Islam, 4 Dec 2024

Import value drops in 0-1% duty goods, marking decline in trade-based money laundering

Reyad Hossain, 14 Dec 2024

প্রকাশ্যে আসছে পুঁজিবাজারের রাঘববোয়ালদের নাম

সাখাওয়াত হোসেন সুমন, 15 Dec 2024

Non-Leather Footwear Export Growth Bangladesh

Jagaran Chakma, 17 Dec 2024

হাসিনার লুটপাটতন্ত্র যেভাবে সুশাসন ও অর্থনীতিকে তছনছ করে দিল

মইনুল ইসলাম, 26 Dec 2024

তিন গভর্নর যেভাবে ব্যাংক খাতে অনিয়মের সহযোগী হয়ে ওঠেন

সানাউল্লাহ সাকিব, 29 Dec 2024

ADB Loan Conditions For Bangladesh

Rejaul Karim Byron , AM Jahid, 3 Jan 2025

The announced gas price hike will likely trigger a significant industrial slowdown. While this presents clear economic challenges, there may be a silver lining in potentially reducing public debt's outsized role in our financial system.

This shift, combined with the new merchant electricity generation policy, could catalyze a solar boom similar to what Pakistan experienced in 2023-24. However, we face some unique constraints here. The current ban on solar installations on agricultural land means companies are limited to rooftop solar and whatever additional capacity they can squeeze onto their private property, like garage tops. We might see rural households increasingly going off-grid with solar solutions – a pattern already common in rural Bangladesh.

The emerging ecosystem of SMEs involved in solar Commercial & Industrial PPAs could become an interesting political force. They may organize to push for lifting the agricultural land restrictions, much like how working-class Bangladeshis successfully drove the electric three-wheeler revolution despite resistance from urban middle-class circles.

The tariffs on solar imports remain problematic. While there's a vocal pro-import substitution lobby defending these tariffs, I maintain that reducing our exposure to volatile energy imports should take precedence over nurturing a domestic solar panel assembly industry. Energy independence is more crucial for sustainable industrialization than protecting this particular manufacturing sector.

Thank you. Useful writeup. But can kindly cite data sources in a revised version? I ask because your piece is a good reference.