Trendspotting - Autumn 2023

The ruddderless economy is careening towards a cliff as the election approaches

The latest data shows that the policy settings are still unsuitable for an inflationary environment, and the macroeconomy is edging towards a precipice. With policy settings remaining inappropriate, households and businesses have struggled to adjust to the inflationary environment. Government borrowing continues apace, despite stringency measures and solid revenue mobilisation. With borrowing rates below the rate of inflation, the real interest rate continues to be negative. The macroeconomic policy setting has buoyed private demand and partly offset import controls. Import controls and other supply shocks such as electricity shortages are hitting productions and fuelling inflation. While strong exports growth has helped stem the erosion of the Bangladesh Bank’s foreign reserves, remittances have remained weak, possibly reflecting expectations of further sliding of the exchange rate. Fundamentally, the mishmash of confused and contradictory steps surrounding the exchange, interest rate, and fiscal policies is pushing the economy rudderlessly towards a crisis.

It should be noted that the indicators only represent the urban, formal economy, and not the rural, agricultural, and the informal sectors. It’s hard to see the informal sector avoiding the inflationary environment prevailing in the formal economy. However, remittances through the informal hundi channel may well be providing a cushion to the households.

The Bangladesh Bureau of Statistics has recently started publishing quarterly national accounts, which show that on year-ended terms, real GDP grew by a rate of around 6-8 percent before the pandemic. The series also confirms that Bangladesh did suffer a pandemic-induced recession between June quarter 2020 and March quarter 2021, but a strong recovery was underway thereafter. The economy slowed sharply in the June quarter 2022, with the industry sector performing particularly poorly. Chart 1 shows year-ended growth in real GDP, with contribution from agriculture, industry, and services sectors.

While the national accounts for 2022-23 fiscal years are yet to become available, other indicators suggest the weakness in production continued. Chart 2 confirms both the pandemic recession and recovery in the growth of electricity generation and sales (volume) — both series slowed significantly in the second half of 2022. Chart 3 shows the same pattern in cement production.

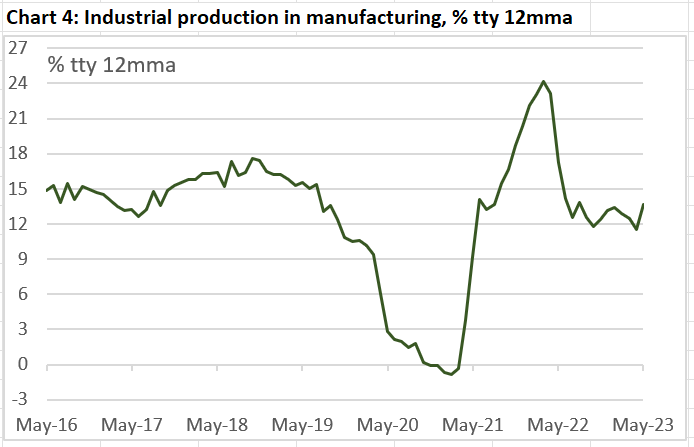

Industrial production, however, have continued to grow strongly (Chart 4), and exports seem to be returning to the pre-pandemic trend (Chart 5) — data for neither indicators is available beyond the summer.

Imports growth have decelerated sharply in 2022-23 fiscal year (Chart 6), undoubtedly reflecting the government restrictions. Growth in credit to private sector also waned in the first half of 2023 (Chart 7).

Notwithstanding the economic slowdown, tax revenue grew strongly in 2022-23 (Chart 7), partly reflecting revenue mobilisation measures implemented as part of the IMF program. Charts 8 and 9, however, show that there was a sharp slowdown in government expenditure in 2022-23 fiscal year.

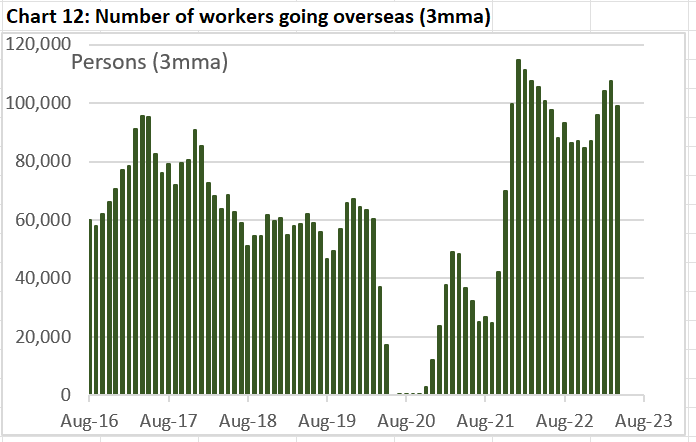

Remittances have been exhibiting sharp volatility in recent years, likely reflecting the pandemic-induced disruptions in the informal hundi channel. Remittances slumped from record growth in mid-2021 and are yet to recover (Chart 11). In contrast, the number of workers going overseas staged a strong recovery (Chart 12). Recent weakness in remittances despite the strength in the overseas workers series likely reflect the volatility in foreign exchange market, which discourages workers from using the formal channel to remit money. Specifically, given the concerns about foreign reserves in particular and the lack of transparency around policies in general, remitters may well be expecting further depreciation of taka in the coming months, and therefore holding off their current remittances through the formal channel.

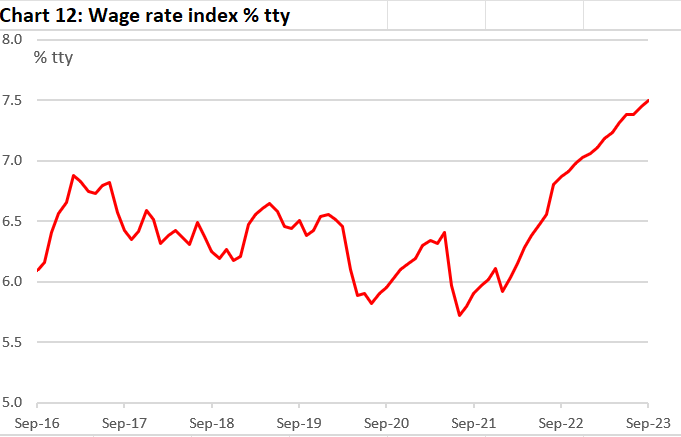

Wage rates growth accelerated in 2023 (Chart 13), but inflation has surged surged even faster (Chart 14). The cost of living pressure, particularly from food price inflation, is also evident in the record high price of rice (Chart 15).

With borrowing and lending rates below inflation, the real interest rates have been negative (Chart 16). Meanwhile, austerity measures and revenue mobilisation notwithstanding, public sector borrowing is still growing at a brisk pace (Chart 17). That is, the macroeconomic policy setting is likely to be adding to inflation than curbing it. Further, banks remain saddled with non-performing loans. After declining steadily for months, Bangladesh Bank’s stock of reserves (measured in line with international standards) appear to have stabilised to cover four months of imports (Chart 18).

All data are from CEIC Asia Database. Variables have been smoothed as indicated, with the latest datapoint indicated in the charts. Calculations available upon request.

Further reading

সুদ পরিশোধে ব্যয় সাত বছরেই তিনগুণ!

মো. মাসুম বিল্লাহ, 23 May 2023

The Monetary Policy Statement announced by the Bangladesh Bank (BB) for the second half of 2023 makes timid use of the instruments available to tighten money, notwithstanding the apparently "contractionary" stance, to combat spiraling inflation head on and stem, if not repair, the deepening dollar shortage.

Zahid Hussain, 19 Jun 2023

Fiscal deficits matter for macroeconomic stability

The inability to mobilise adequate revenues despite securing rapid GDP growth has weakened the quality of fiscal management. This issue has become important over the past several years as the tax to GDP ratio continues to fall, whereas fiscal deficit, public debt and interest cost as shares of GDP and total revenue are rising

Sadiq Ahmed, 20 Jun 2023

শুভংকর কর্মকার ও সানাউল্লাহ সাকিব, 24 Jul 2023

রেন্টাল-আইপিপির বিল না দিয়ে জরিমানা সুদ গুনছে পিডিবি!

প্রতি বছর বাড়ছে জরিমানা সুদের পরিমাণ

ইসমাইল আলী, 3 Aug 2023

Why inflation persists at a higher level in Bangladesh

The Ministry of Finance and Bangladesh Bank have blamed external factors for inflation while they failed to adopt the right fiscal and monetary policy measures, said economists

Anisul Islam, 7 Aug 2023

Why unified exchange rate couldn't stop dollar sale from reserve

The Bangladesh Bank sold $1.14 billion from reserve this July even after the biggest devaluation of taka, as import rate rises to Tk116

Jebun Nesa Alo, 6 Sep 2023

Powder milk imports dip to 8-year low as consumers tighten belts

Sohel Parvez, 11 Sep 2023

Sovereign debt of Bangladesh: Where do we stand?

Bangladesh is at a critical stage regarding the issue of foreign debt, especially considering many ongoing and upcoming development projects

Zahid Iqbal, 11 Sep 2023

সরকারি চাকরিজীবীদের ভবিষ্য তহবিলে সর্বোচ্চ সুদ, বেসরকারির ওপর কর

রাজীব আহমেদ, 24 Sep 2023