The latest data shows that the policy settings are yet to adjust to the inflationary environment, and the macroeconomy remains dangerously unstable. Notwithstanding stringent austerity measures, government borrowing continues apace. With interest rates capped below the rate of inflation, the real cost of borrowing has been negative. This has been fuelling growth in private demand and imports, though both have started slowing. In the meantime, remittances have remained weak, possibly reflecting expectations of further sliding of the exchange rate. While strong exports growth has helped stem the erosion of the Bangladesh Bank’s foreign reserves, electricity shortages are hitting productions, putting future exports growth at risk. Fundamentally, the lack of transparency surrounding the exchange, interest rate, and fiscal policies is adding to the uncertainty.

It should be noted that the indicators only represent the urban, formal economy, and not the rural, agricultural, and the informal sectors. It’s hard to see the informal sector avoiding the inflationary environment prevailing in the formal economy. However, remittances through the informal hundi channel may well be providing a cushion to the households.

Overall Assessment

With policy settings remaining inappropriate, households and businesses have struggled to adjust to the inflationary environment. Government borrowing has continued apace despite stringent austerity, while private demand has been boosted by negative real interest rates caused by the caps on the nominal rate of borrowing. With production of goods and services being hampered by electricity shortages, demand growth has been fuelling inflation. Strong demand has also acted to offset various government curbs on import. Meanwhile, uncertainties remain around the exchange rate, which has been affecting remittance flows. Exports have remained strong, helping stem the erosion of the central bank’s foreign reserves. But problems in the electricity sector have started affecting industrial productions. Overall, the economy remains dangerously unbalanced.

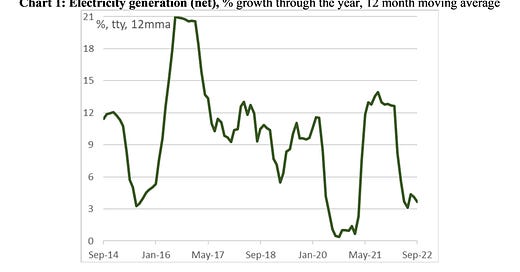

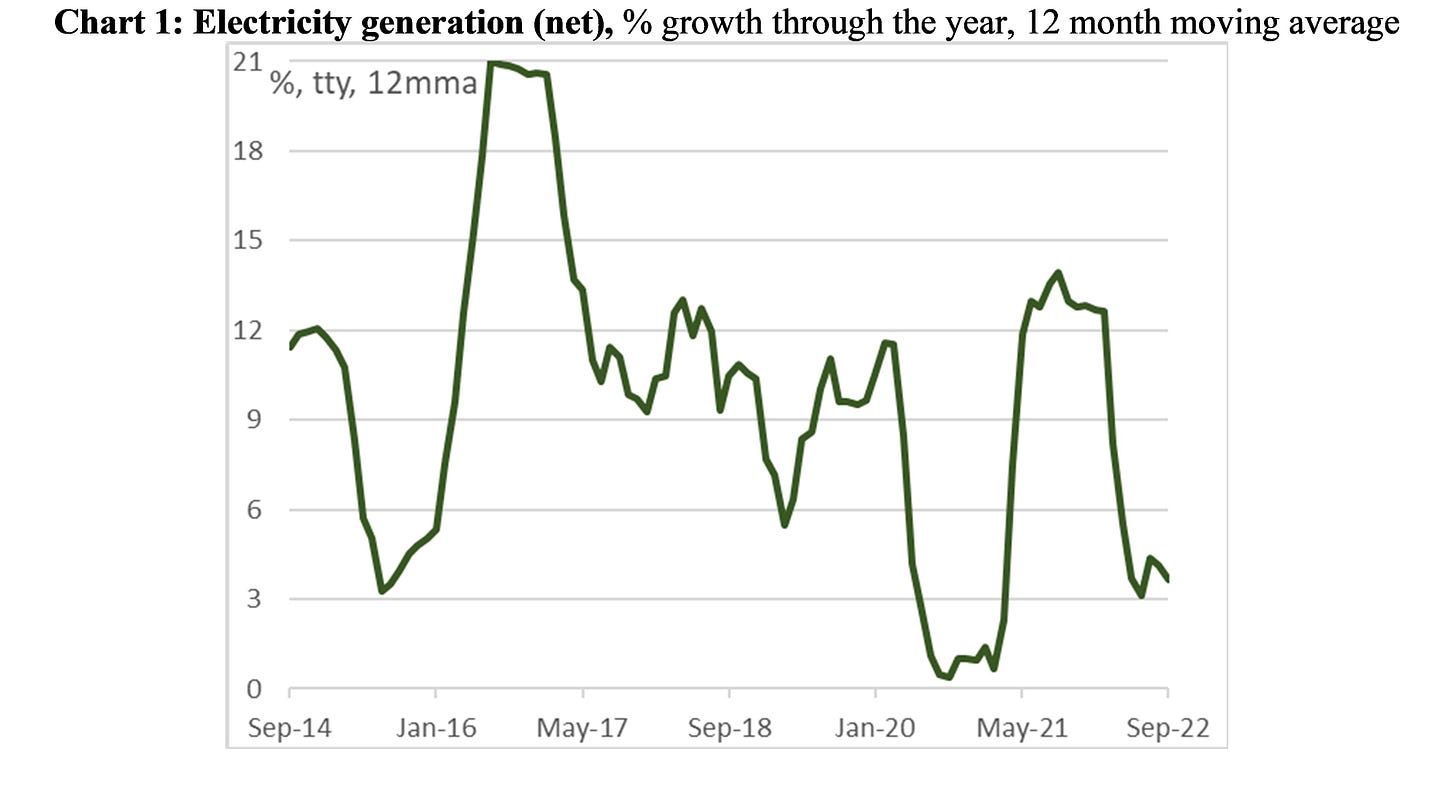

Electricity Generation Prior to the pandemic, electricity generation (which is a proxy for overall activity in the economy) was growing by 9-11% a year. After recovering from the pandemic in 2021, this series started slowing sharply into the summer of 2022, reflecting the widespread loadshedding reported in the media. Growth in the series was less than 4% in the year to September 2022 —the latest period for which the government has published data.

Industrial production Prior to the pandemic, this series recorded yearly growth of 14-16%. Since the post-pandemic recovery in 2021-22, growth in the series has reverted to the pre-2020 trend. Industrial production grew by 13% in the year to December 2022. The sharp slowdown in the series is consistent with the slowdown in the electricity generation as well as media reports of supply chain difficulties.

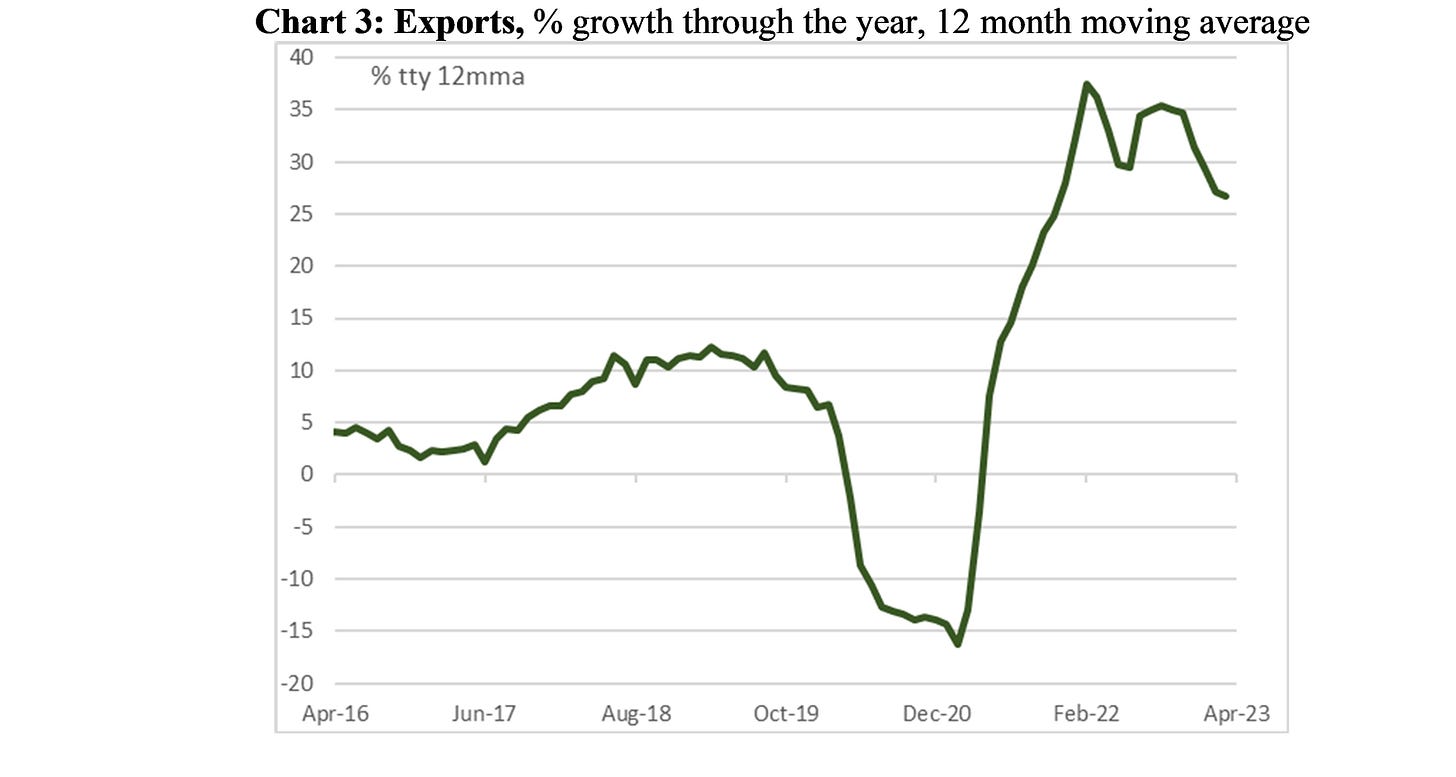

Exports Exports also staged a strong post-pandemic recovery from mid-2021, which has continued into 2023, with growth in the series of around 27% in the year to April 2023 (compared with around 10% in 2018-19).

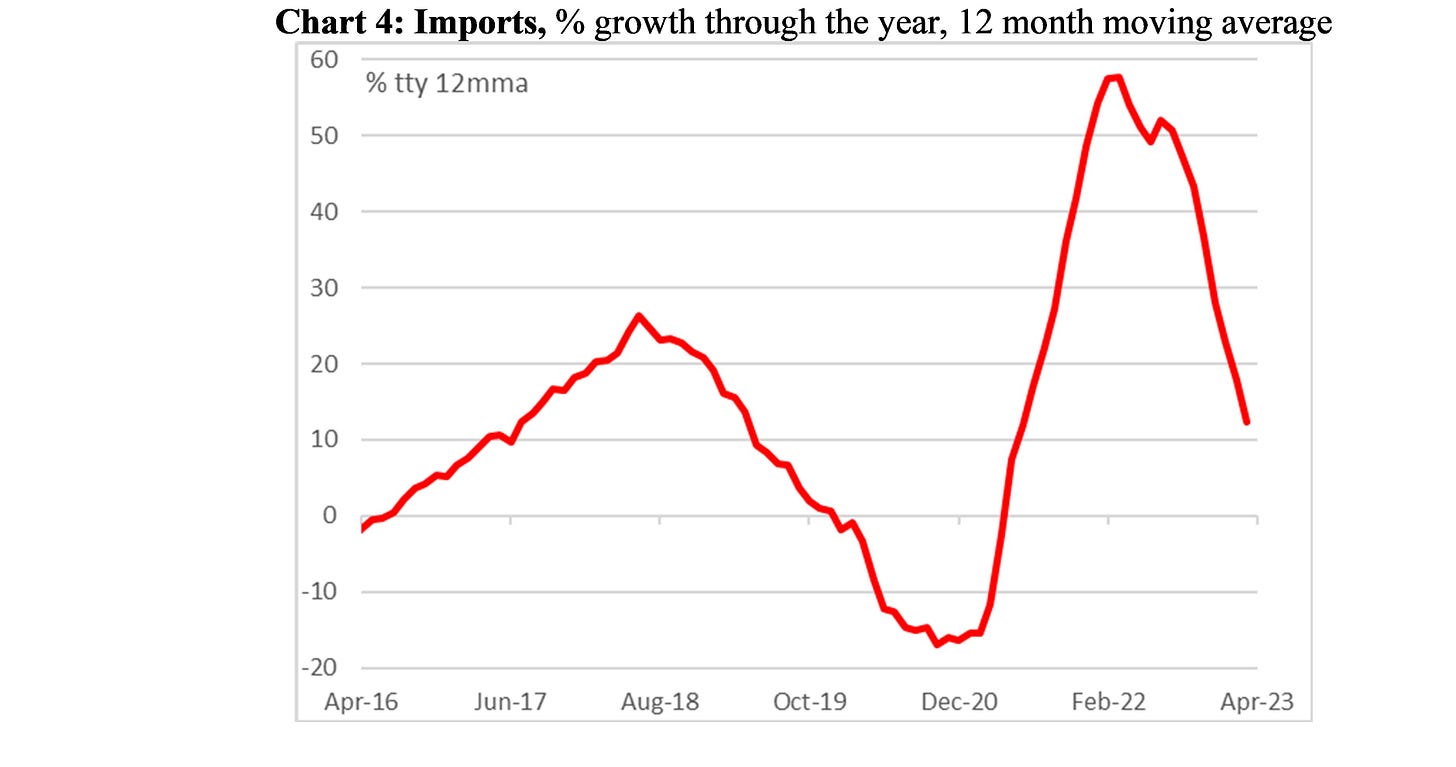

Imports Following the post-pandemic recovery in 2021, imports growth surged further in the summer of 2022, partly reflecting high global energy and intermediate goods prices. Since then, imports growth have slowed sharply in response to various government measures. Nonetheless, imports grew by 12% in the year to April 2012, similar to the pre-pandemic pace (though imports started slowing well before the pandemic).

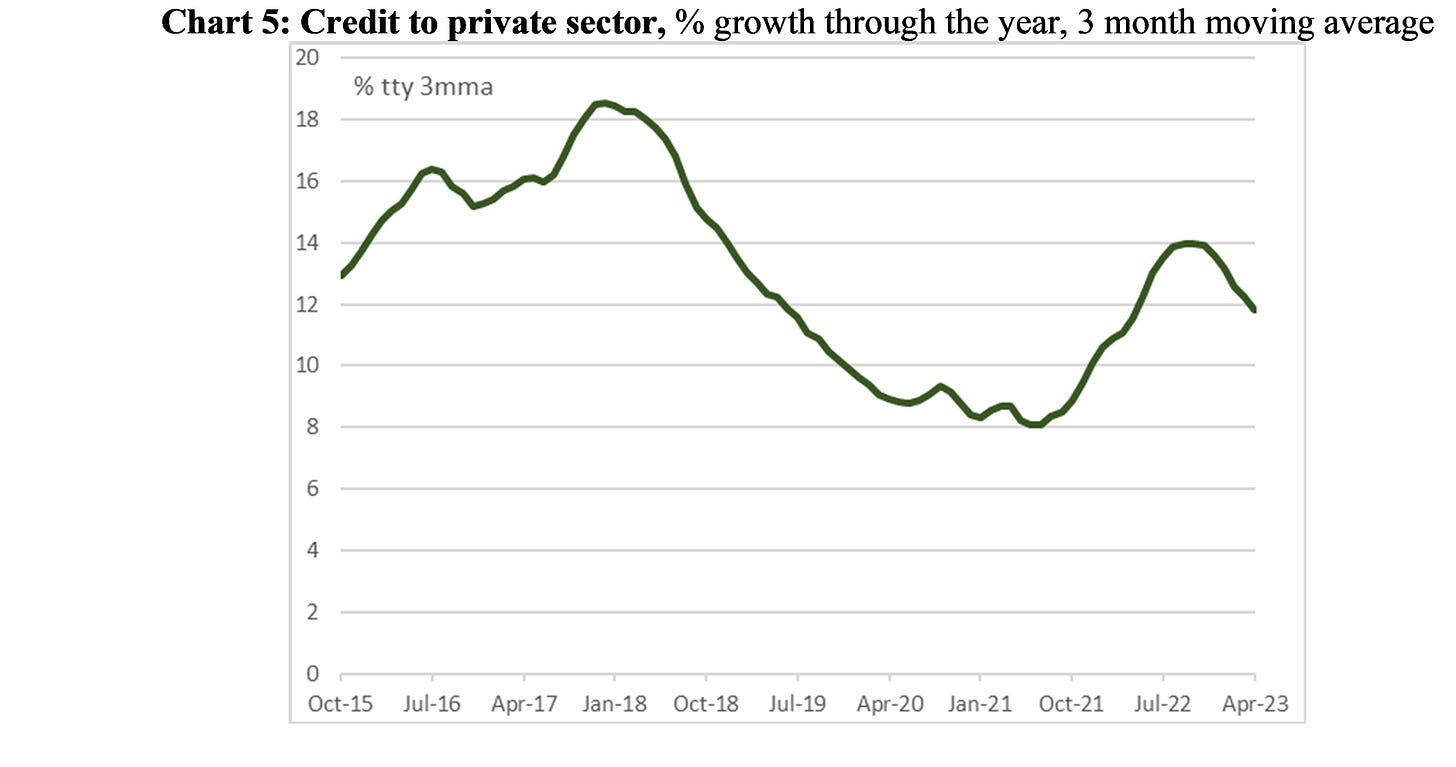

Credit to private sector A proxy for private investment demand, this series staged a healthy recovery in 2021-22 before starting to moderate, growing by 12% in the year to April 2023 (compared to the 14-16% range witnessed in the mid 2010s).

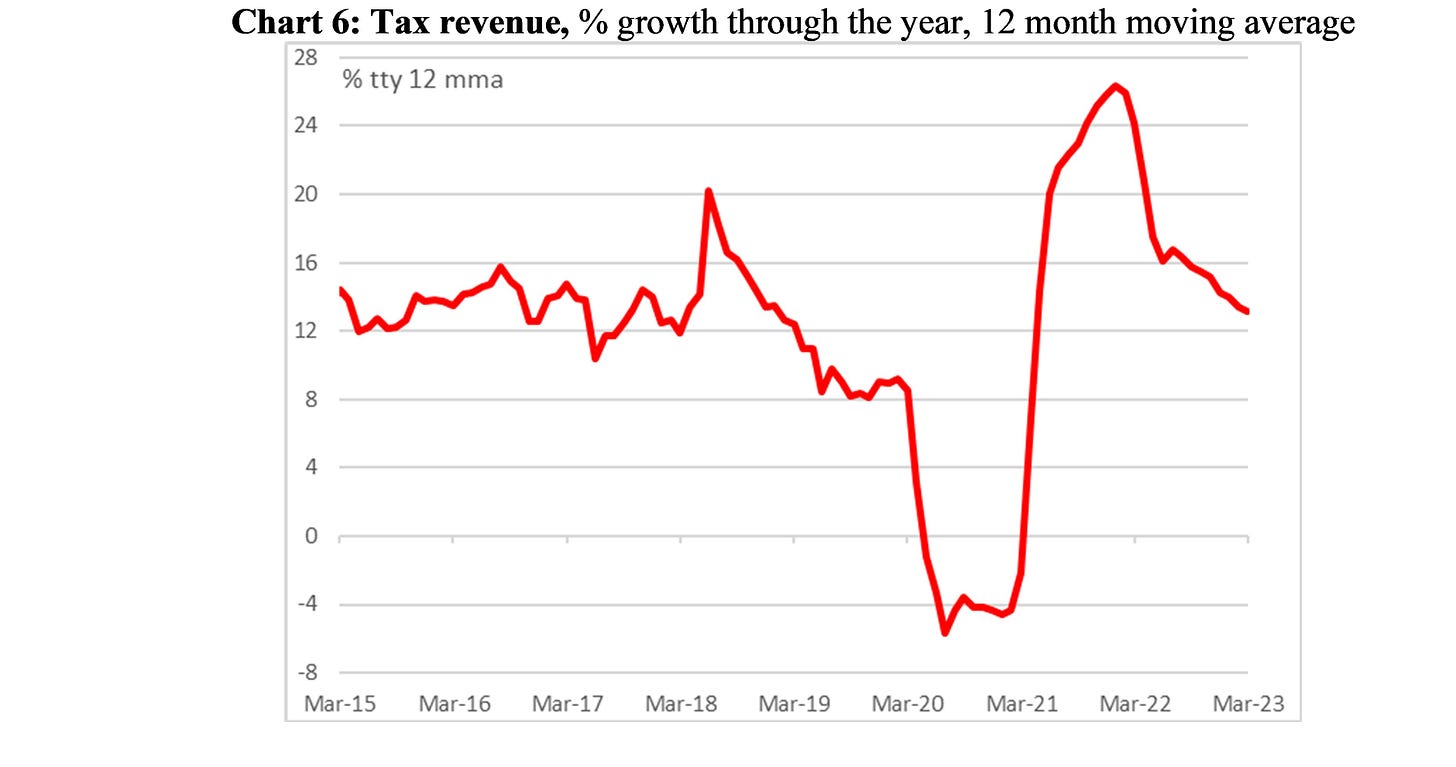

Tax revenue After the strong post-pandemic recovery in 2021-22, tax revenue growth has eased to 13% in the year to March 2023, similar to the 12-15% range witnessed in the mid-2010s.

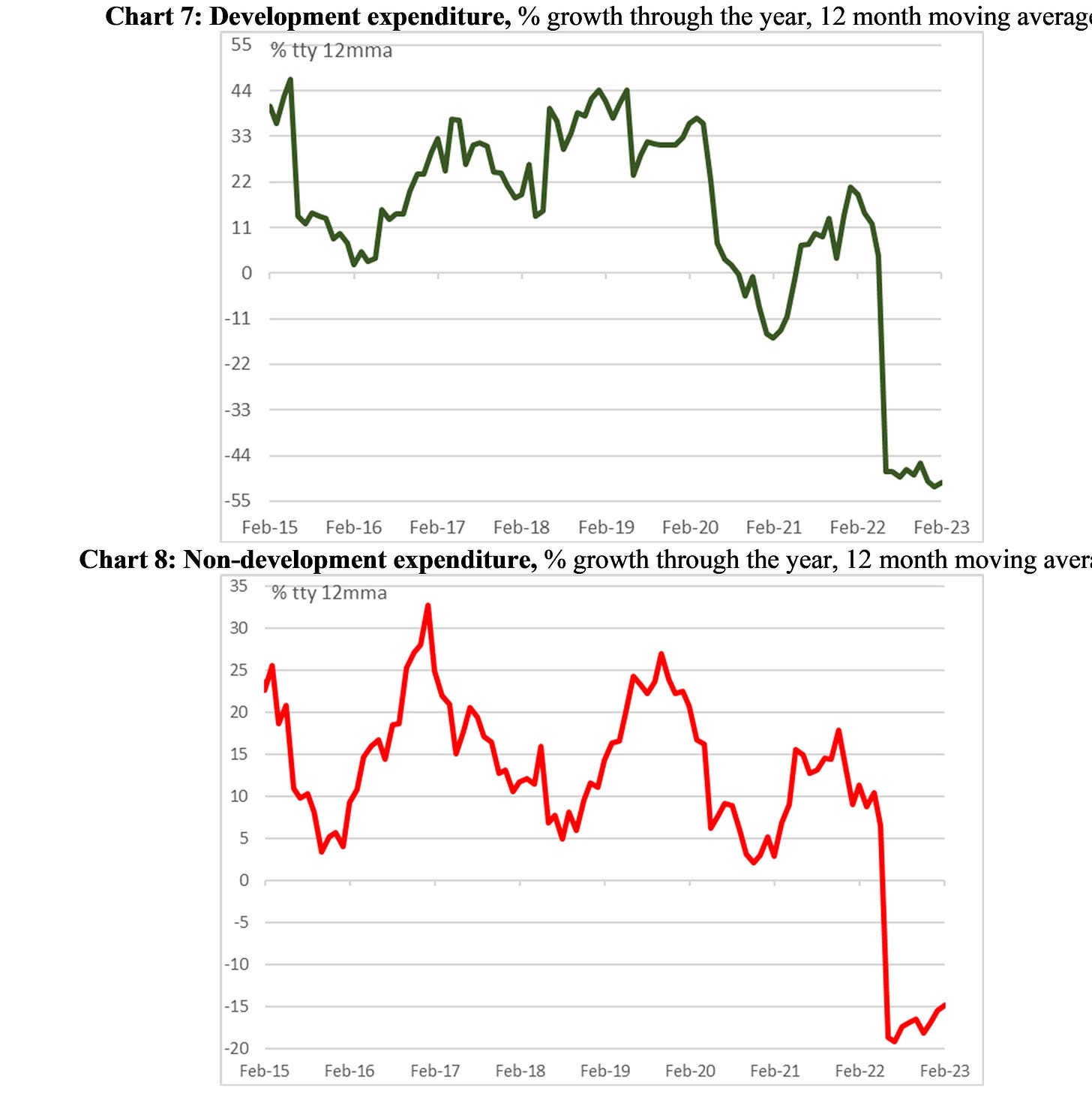

Development and non-development expenditure Both recovered in 2021-22, but the effects of austerity measures are visible in both series exhibiting declines in the first two-thirds of 2022-23 fiscal year.

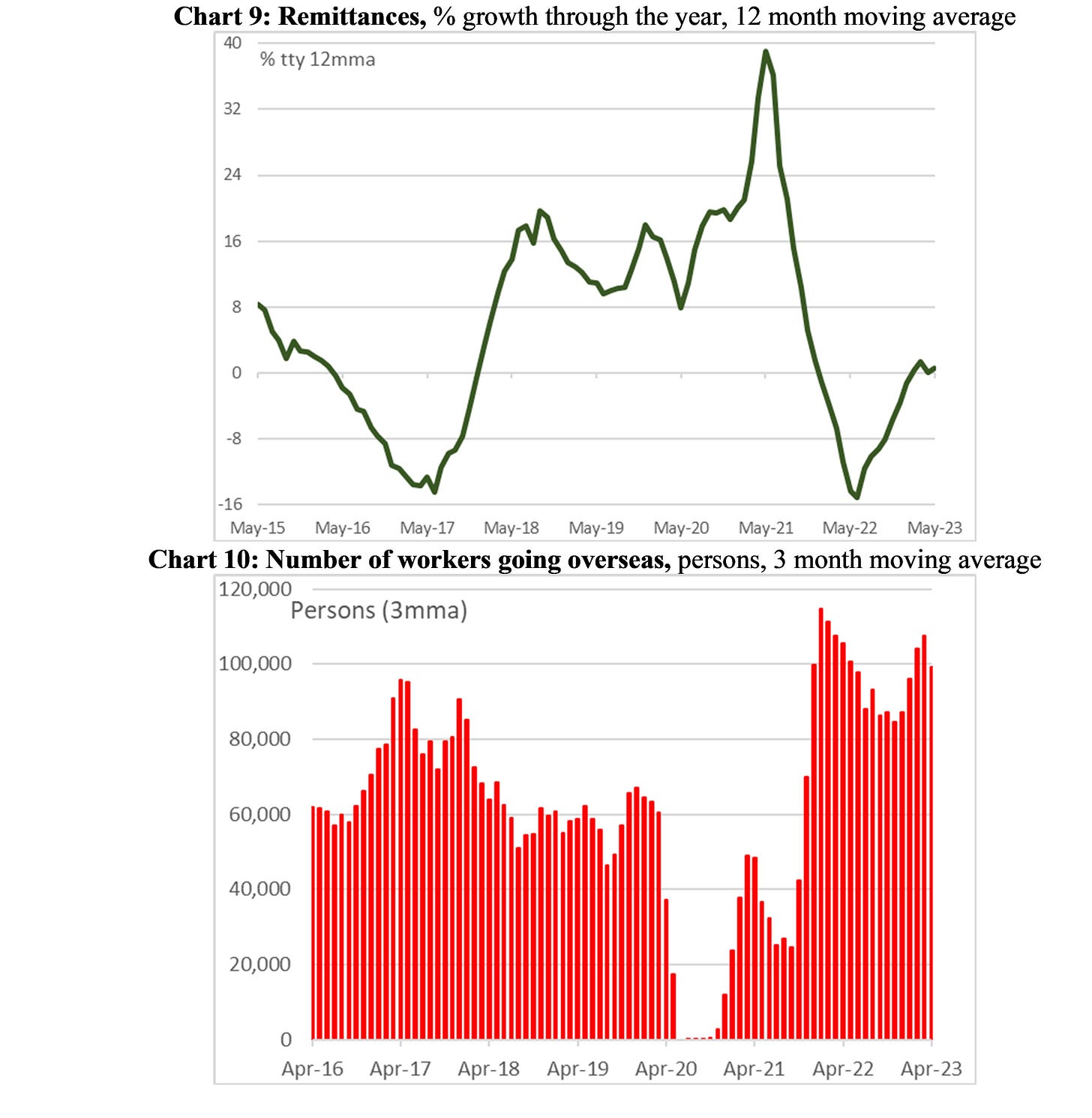

Remittances and Overseas Workers Remittances have been exhibiting sharp volatility in recent years, likely reflecting the pandemic-induced disruptions in the informal hundi channel. Remittances slumped from record growth in mid-2021. In contrast, the number of workers going overseas staged a strong recovery, with record numbers leaving in the first half of 2022. Recent weakness in remittances despite the strength in the overseas workers series likely reflect the volatility in foreign exchange market, which discourages workers from using the formal channel to remit money. Specifically, given the concerns about foreign reserves, remitters may well be expecting further depreciation of taka in the coming months, and therefore holding off their current remittances through the formal channel.

Wage rate index, inflation, price of rice Wage rates had grown by historically fast pace of over 7% in the year to May 2023. However, inflation surged even faster, with consumer prices rising by over 9% in the year to March (non-food inflation was nearly 10%). The cost of living pressure was evident in the price of rice topping 65 taka a kg in late 2022.

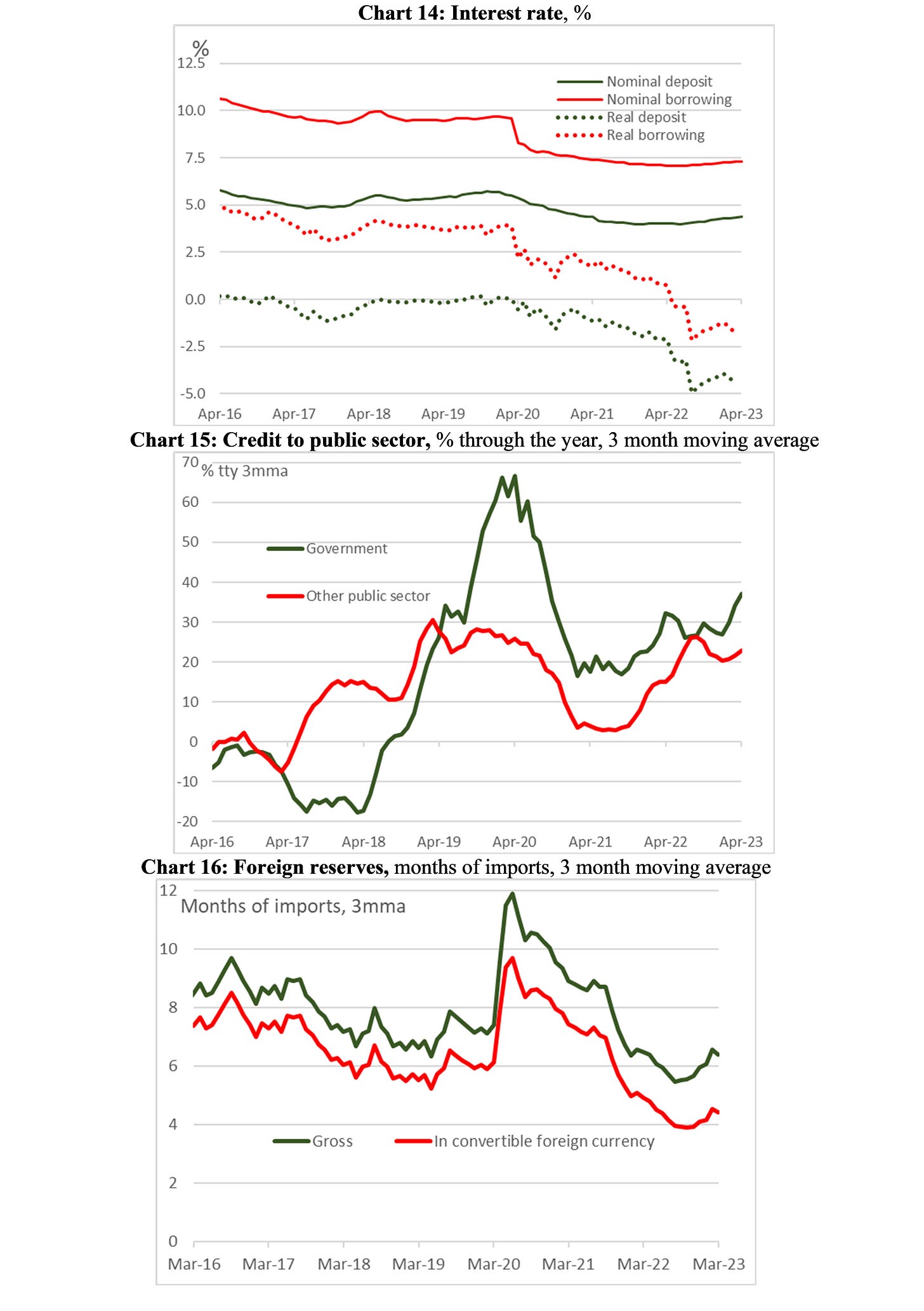

Interest rates, credit to public sector, non-performing loans, and foreign reserves With borrowing and lending rates below inflation, the real interest rates have been negative, contributing to the growth in private credit (Chart 5). Austerity measures notwithstanding, public sector borrowing is still growing at a brisk pace. That is, the macroeconomic policy setting is likely to be adding to inflation than curbing it. Further, banks remain saddled with non-performing loans. After declining steadily for months, Bangladesh Bank’s stock of reserves (measured in line with international standards) appear to have stabilised in recent months to cover four months of imports.

Further reading

If it ain’t broke, don’t fix it?

Policy reforms involve risks -- but that’s not an excuse for inaction. What is required is the vision and patience to build risk management capacities

Syed Akhter Mahmood, 27 Feb 2023

Import of 20 goods thru Ctg port halves, revenue drops by Tk2,514cr

Shahadat Hossain Chowdhury, 24 March 2023

Soon income tax agents may appear at your door regularly to collect your taxes

Jasim Uddin 5 May 2023

গত বছর পোশাক রপ্তানিতে ২৭.৬৪% প্রবৃদ্ধি হয়েছিল। চলতি বছরের প্রথম চার মাসে প্রবৃদ্ধি কমে হয়েছে দশমিক ৭৭ শতাংশ।

শুভংকর কর্মকার, 26 May 2023

জ্বালানি সংকটে শিল্পোৎপাদন অর্ধেকে নেমেছে

সাইফুল আলম, 4 June 2023

RMG export income rises, raw material imports fall in Q1

The country's garment exports amounted to $12.25 billion in the first quarter of this year, while the raw material imports for that sector during the same period were $3.54 billion

Sakhawat Prince, 6 June 2023

বিশ্ব অর্থনীতির সংকট তো ছিলই। তবে দেশের অর্থনীতিতে সংকট বেড়েছে নানা ভুল নীতির কারণেও।

শওকত হোসেন, 10 June 2023

Marrying ambition with reality

Imperative going forward is to contain operating expenses, including subsidies; increase spending efficiency in the public investment programme; and widen social assistance while reaching better the poor and the vulnerable.

Zahid Hussain, 16 June 2023

Why dollar crisis persists despite declining imports

The country's banking sector has been experiencing higher outflow than inflow in foreign currency due to repayment pressure of private sector short-term foreign loans when external borrowings of banks declined substantially after Moody's downgraded the banking system

Jebun Nesa Alo & Sakhawat Prince

17 June, 2023

And some music that befits an economy adrift.