The economic vaccine jabs

Macroeconomic stability and better-functioning markets are the two doses of economic vaccine jabs we need.

Every October, finance ministers and central bank governors from around the world gather for the annual meetings of the International Monetary Fund and the World Bank. The meetings, and accompanying seminars, roundtables, workshops, lectures and so on, are also attended by senior officials responsible for economic development, civil society participants, academics and public intellectuals, corporate representatives, and, of course, protesters. Washington DC is the usual venue, but once every three years, the meetings take place elsewhere. Marrakesh is scheduled to host them in 2022.

With the delta variant still rampant around the world, this year's meetings will be a hybrid of the physical and virtual. Also casting a pall over the proceedings will be the so-called 'doing business scandal', with a blistering call by the Economist magazine for the IMF chief Kristalina Georgieva to quit.

In 2003, the World Bank started publishing an index that rated and ranked countries based on their regulatory and legal environments, ease of business start-ups, financing, infrastructure, and other business climate measures. The 'Doing Business' indicators were taken seriously by multinationals, development practitioners, and governments around the world. For example, in 2017, China's prime minister expressed concern that his country was falling behind.

Following that, China's scores improved. And now, an independent report claims that the report was tampered with by the Bank's then-CEO Georgieva under "undue pressure" from China. At the time of writing this, the future of the IMF chief hangs in the balance, while the World Bank had already cancelled the annual Doing Business Report.

The Doing Business indicators reflected one plank of the so-called Washington Consensus, the other plank being macroeconomic stability through prudent monetary and fiscal policies. The idea was that countries with sound public finances, well-run banks, liberal trade and foreign investment regimes, and rule of law would see more investment, innovation, economic growth, jobs, and income over time.

These policy prescriptions reflect the mainstream, neoclassical economics that dominates international financial institutions, as well as finance ministries and central banks in major economies.

According to Kevin and Robin Grier of Texas Tech University, the Consensus worked along the lines expected by its proponents.* Looking at 141 countries between 1970 and 2015, the authors identified 49 cases of policy reforms as prescribed by the Consensus.

They found that countries adopting Washington Consensus policies, on average and after accounting for other factors, grew by 2.1-2.9 percentage points faster in the post-reform five years (and 1-1.9 percentage points faster over ten years) than countries that had not.

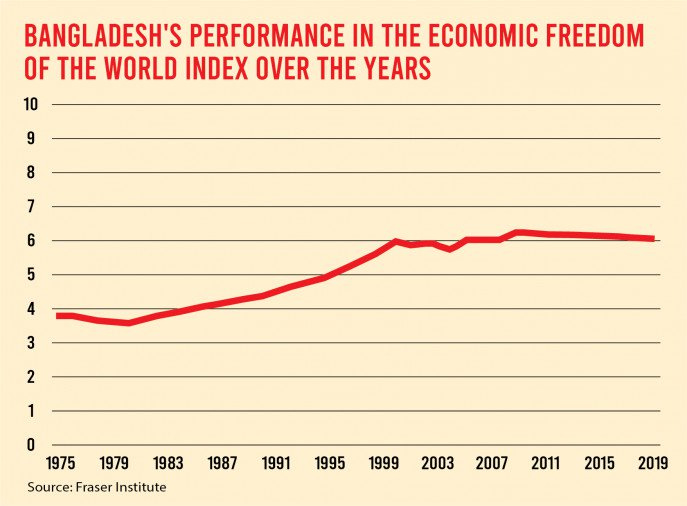

The authors used the Economic Freedom of the World Index by the Fraser Institute, a Canadian think tank, to identify the countries that adopted Consensus prescriptions. In this index, countries are given scores between 1 and 10. The index comprises five elements: the size of government and taxation, private property and the rule of law, sound money, trade regulation and tariffs, regulation of business, labour and capital markets. The higher the score, the more in line with the Consensus a country is.

From this, a simplistic assertion would be that liberalised economies with deregulated markets and privatised industries would perform better. A more nuanced interpretation is that a country with a government that can finance its budgets and enforce the rule of law and a well-regulated private sector (including banks) that is globally competitive is more likely to be resilient to adverse shocks. In such a country, when an adverse shock hits, prices would adjust and resources would flow to their most best uses, while the government would have sufficient resources to cushion the blow for the most disadvantaged.

Seen from this perspective, the Griers' finding is that the countries that did not adopt the Washington Consensus are likely to grow slower than those that did. Seen in this light, the Consensus is like a vaccine that makes one more resilient to diseases, as opposed to increasing one's fitness or stamina.

The authors identify reform cases as those countries experiencing a one-point jump in five years, with the higher score sustained for the following decade. Bangladesh just misses out on making the cut — the country's score increased by 0.99 in the five years to 2000. Over the two previous decades, the score had been steadily rising. This trend stopped after 2000, and Bangladesh's score has actually declined since 2009 (Chart below).

That is, if the authors' calculations are taken literally, Bangladesh would have grown much faster if the pre-2000s policy trends had continued over the last two decades.

One can quibble about this or that weight and calculation behind Bangladesh's score in the index for a given year. But taking a step back, let us ask whether the country's banks, financial markets, and various specific sectors were better regulated in the 2010s or 1990s? In which decade did we see more scandals? In which decade were the courts more trusted?

An honest introspection on any of these questions would lead to the very unsettling conclusion that Bangladesh has not done as well as might have been expected at the turn of the century. Regardless of what is discussed in Washington DC this October, macroeconomic stability and better-functioning markets are the two doses of economic vaccine jabs we need.

Unfortunately, the chart above does not inspire much confidence about the chances of Bangladesh getting the jabs.

A slightly shorter version was first published by The Business Standards.

*Grier Kevin M and Grier Robin M, 2021, The Washington Consensus Works: Causal Effects of Reform, 1970-2015, Journal of Comparative Economics.

Traditional policy reforms of the type embodied in the Washington Consensus have been out of academic fashion for decades. However, we are not aware of a paper that convincingly rejects the efficacy of these reforms. In this paper, we define generalized reform as a discrete, sustained jump in an index of economic freedom, whose components map well onto the points of the old consensus. We identify 49 cases of generalized reform in our dataset that spans 141 countries from 1970 to 2015. The average treatment effect associated with these reforms is positive, sizeable, and significant over 5- and 10- year windows. The result is robust to different thresholds for defining reform and different estimation methods. We argue that the policy reform baby was prematurely thrown out with the neoliberal bathwater.