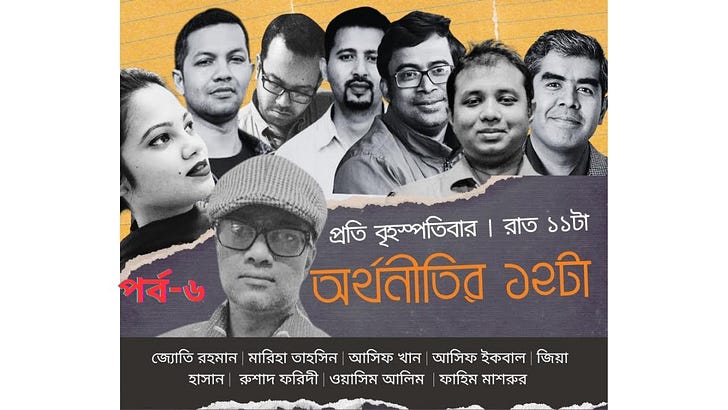

I discuss with Asif Khan the evolution of the budget size, split of development and non-development budget, the key components of the non-development budget and the sources of change over the past 15 years. We argue that a supplementary budget is long overdue.

Further reading

Jeremy Bulow, Carmen Reinhart, Kenneth Rogoff, Christop Trebesh, 1 Sep 2024

Sadiqur Rahman, 28 February 2024

Atif Mian, 1 Mar 2024

Odious Debts: What Can Bangladesh Learn from Ecuador?

Anis Chowdhury and Khalilur Rahman, 16 Sep 2024

আমলাতান্ত্রিক সংস্কৃতির পরিবর্তন কেন প্রয়োজন

গোলাম রসুল, 19 Sep 2024

Revamping bureaucracy: How to get rid of political patronage?

Mohammad Kamrul Hasan, 20 Dec 2024

জনপ্রশাসন ঠিক হোক, তা ভেতরের লোকজনই চায় কি

সুবাইল বিন আলম, 26 Dec 2024

Cost of all types of air tickets to rise

Reyad Hossain, 1 Jan 2025

I appreciate your detailed analysis of Bangladesh's budget, but I must strongly disagree with several of your conclusions.

Your central argument that corruption stems from low salaries makes little logical sense. Consider the reality of our public sector: people spend years preparing for civil service exams, often taking them multiple times, competing for positions with a 5-10% acceptance rate. This intense competition for government jobs clearly indicates that public sector workers are already overcompensated, not underpaid. If anything, we should be reducing wages until we reach a more reasonable market equilibrium.

Your suggestion to benchmark public sector wages against neighboring countries is equally problematic because they face the same problem of public sector overcompensation. Take India, for instance, where public school teachers earn 4-5 times more than their private sector counterparts yet deliver worse outcomes, with rampant absenteeism.

This isn't just theoretical speculation. The Indonesia experiment provides concrete evidence - when they doubled teacher salaries to combat absenteeism, the only change was increased job satisfaction. No improvement in attendance or performance. Hardly surprising, given they were already overpaid.

Looking forward, I have two pressing concerns. First, given our current fiscal challenges, shouldn't we be considering aggressive privatization, particularly in the banking and power sectors, to address our public debt? Second, with WTO rules requiring us to slash tariffs after 2026, how do we plan to replace the 33% of tax revenue they currently provide?

My suggestion would be a shift toward property and land taxes while eliminating income tax. We shouldn't be taxing productive work when we have better alternatives available.