Asif Khan takes us through the basics.

Further reading

My money or your life: the bank robbers of Beirut

Wendell Steavenson, 27 Dec 2022

The Economist, 20 Aoril 2023

Chloe Cornish, 29 April 2023

NBR agrees on coming out of non-refundable minimum tax system

Reyad Hossain, 30 Oct 2024

ইসমাইল আলী, 4 Nov 2024

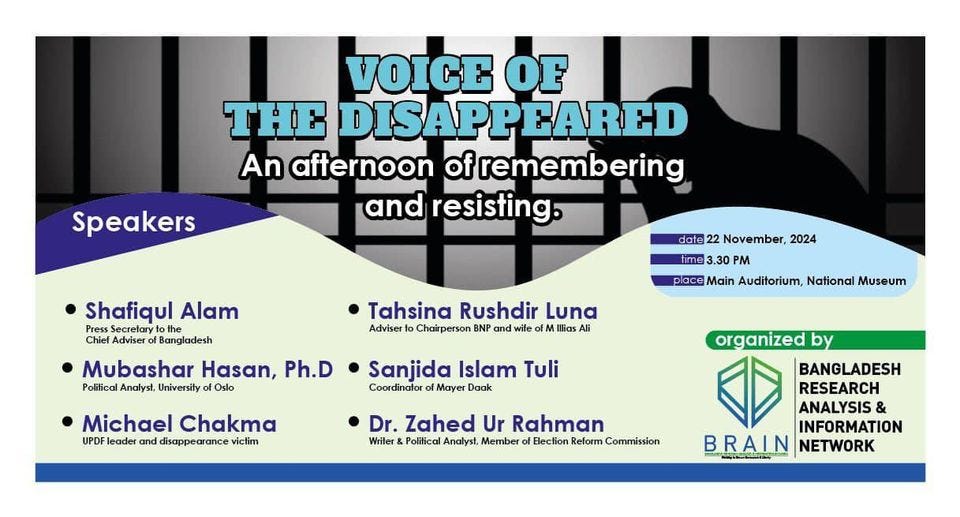

Bangladesh Research Analysis & Information Network event on 22 Nov 2024

The apparent paradox in Bangladesh's banking sector - high fragmentation yet minimal specialization - can be traced directly to Bangladesh Bank's dirigiste approach to credit allocation. Through sectoral lending quotas (manufacturing, shipbuilding, green energy, etc.), the central bank effectively homogenizes bank portfolios, negating the natural evolutionary advantages of market specialization.

This policy framework represents a classic case of regulatory-induced market distortion. To foster genuine financial innovation and allow banks to develop comparative advantages, we need to curtail the central bank's discretionary powers in "directing" investment flows. If political constraints make complete quota abolition unfeasible, a pragmatic intermediate step would be establishing a robust secondary market for loans. This would introduce much-needed flexibility, allowing banks to trade exposures to meet quotas while gradually developing specialized competencies aligned with their strategic advantages.

The current system is essentially forcing square pegs into round holes - an inefficient allocation mechanism that undermines the very benefits that banking sector fragmentation should theoretically provide.