There is an old saying among the IMF-watchers that the acronym stands not for the International Monetary Fund but It's Mainly Fiscal. This is because the Fund's prescriptions typically have a strong fiscal component —raise taxes, cut subsidies, repay debt and so on.

The cynics and sceptics point to this as evidence that the Washington institution is fundamentally anti-poor because its austerity prescriptions hurt the have-nots and protect the rich.

A more nuanced interpretation is that, more often than not, countries seeking IMF programs do have major fiscal problems that need addressing, and even when the fiscal problem isn't the immediate cause of concern, tackling it can help catalyse other reforms.

The recent IMF programme for Bangladesh is a good illustration.

Bangladesh sought an IMF package, not as a crisis bailout, but to stabilise the economy in the face of an external shock and then address medium-term challenges. The stabilisation part of the package —exchange rate flexibility and build-up of reserves— is well understood. Less appreciated are the fiscal measures that are at the core of the program in the medium term.

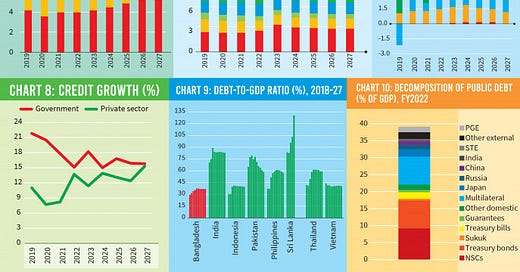

Let's start with Bangladesh's fiscal fundamentals. Bangladesh performs much more poorly than its neighbours when it comes to domestic revenue mobilisation (Chart 1). Put simply, affluent Bangladeshis simply don't pay much tax.

The powers-that-be are acutely aware of this. That's why, every budget contains lofty ambitions to lift revenue collection. And Chart 2 shows that actual revenue collections have typically fallen short of the ambition over the past decade. Interestingly, even though revenue generation regularly falls short of budget targets, budget deficits have typically been smaller than forecasts (Chart 3).

This is because, in practice, the realisation that revenue is undershooting targets is followed by expenditure reprioritisation. And while that prevents a blowout in debt, it also means the Bangladesh government spends less on its citizens than its neighbours. This is illustrated in Chart 4 using public expenditure on health, but the same point holds for education, law and order or any other public service.

That is, it's not the IMF program. Bangladesh's fiscal setting is fundamentally anti-poor to begin with. Whether it's the perilous nature of law enforcement or the dilapidated state of public universities, a state that taxes so little is not likely to govern much, if at all.

Source: IMF World Economic Outlook, October 2022 (Chart 1); CEIC Asia Database and author’s calculations (Chart 2); CEIC Asia Database (Chart 3); World Bank World Development Indicator, 2023 (Chart 4). Charts 1 and 4 are calendar years, while Charts 2 and 3 are fiscal years.

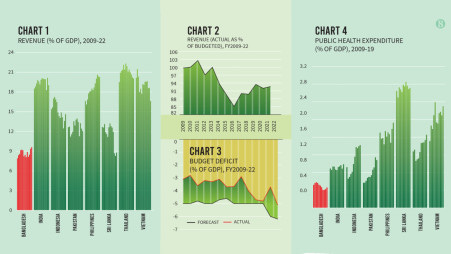

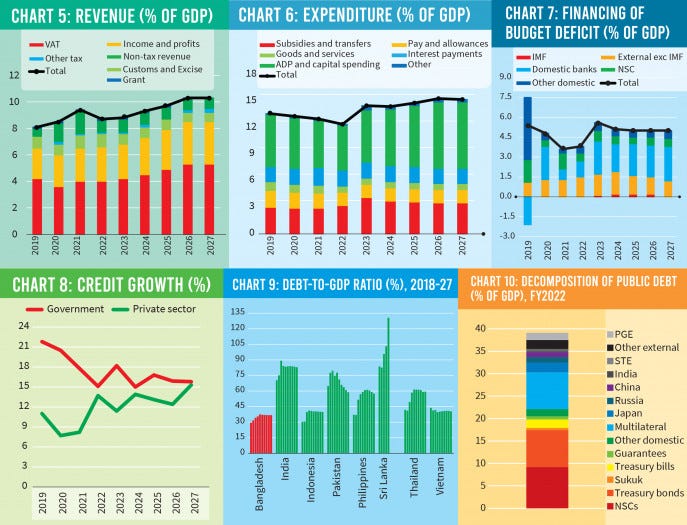

The IMF program tackles this fundamental problem head-on with a series of tax policy and revenue administration measures that, if implemented properly, could raise VAT revenue by 0.5-0.7% of GDP a year over the next three fiscal years. Chart 5 shows the program projections for revenue.

Of course, even if these measures are fully implemented and revenue collections rise as projected, the revenue-to-GDP ratio in Bangladesh will still be lower than most of our neighbours, with hardly any increase in the collection of taxes on incomes and profits. That is, depending on one's perspective, the IMF prescription might be criticised for a lack of ambition, or noted for its realism with respect to implementation

What is the IMF's recommendation on how the extra revenue be spent?

It's not uncommon to hear the refrain that 'subsidies are being cut because of the IMF,' or some variation thereof. This is half-right, and therefore all wrong. One programme condition is that the government introduces a transparent, formula-based fuel price adjustment mechanism such that domestic prices rise, and fall, in line with global prices.

Instead of the current subsidy regime of arbitrary adjustments that may not even be particularly friendly towards the poor, the programme asks for better-targeted social and development spending.

Chart 6 shows that these expenditures are projected to rise relative to GDP compared with the recent past. That is, the 'IMF program is anti-poor' isn't really a criticism that is valid in the Bangladeshi context.

Source: IMF Country Report 23/66, February 2023 for Bangladesh, IMF World Economic Outlook, October 2022 for other countries. Data are for fiscal years for Bangladesh and calendar years for other countries.

In fact, the program envisages budget deficits that are bigger than what has been experienced in the past decade. Chart 7 shows that the bulk of the financing for this deficit is expected to come from domestic banks. And yet, this additional government borrowing is not expected to crowd out growth in credit to the private sector (Chart 8).

A number of monetary, banking and financial sector reform measures are supposed to underpin this rather upbeat scenario. Of course, one can criticise the projections for optimism. But another way to think about the projections is that all the reforms —tax, subsidies, banks, interest rates —need to be addressed for the scenario presented above to materialise.

If things play out as expected, the debt-to-GDP ratio will remain stable at around 40% of GDP, lower than neighbours (Chart 9). In fact, according to the recently published joint debt sustainability analysis, the IMF and World Bank conclude that 'Bangladesh remains at a low risk of external and overall debt distress'. Chart 10 can help explain what underpins this conclusion.

The bulk of the country's external debt is to multilateral creditors who lend on concessional terms. Publicly guaranteed external debt and short-term external debts owed by the government can often trigger debt distress. As of the end of the fiscal year 2022, publicly guaranteed external debt amounted to 1.6% of GDP and short-term public debt was worth 0.5% of GDP — these are much smaller than what usually sets off a crisis.

Of course, all of this is predicated on the assumption that the IMF's analysis is based on reliable data. The accuracy and veracity of data provided by the government are often questioned. For example, can we be confident that the government's fiscal commitments to various state-owned enterprises and agencies —Bangladesh Petroleum Corporation, Power Development Board, and Biman Bangladesh Airlines to name a few — are fully reflected in the fiscal accounts?

Suppose these agencies are in financial distress because of contractual obligations —the recent Adani saga comes to mind, for example. Will the government not be expected to come to their aid? To improve fiscal transparency, the IMF has asked for the publication of a 'fiscal risk statement, covering major risks from SOEs, guarantees and PPPs as part of the FY2025 Budget documentation'. Commentators, pundits and public policy analysts should pore through this statement next year.

That is, the IMF program for Bangladesh is mainly fiscal. Hopefully implementing it will not prove to be a mission impossible!

First published in The Business Standard.

Further reading

সরকারকে ঋণ দিতে আগ্রহ হারাচ্ছে বাণিজ্যিক ব্যাংক!

ইসমাইল আলী ও রোহান রাজিব, 9 Nov 2022

Reforming revenue regulations to rid it of its colonial past

Muhammad Abdul Mazid, 1 Dec 2022

Inflation pressure may ease in a few months

Selim Raihan, 1 Jan 2023

Cenbank goes for printing money to support budget

Jebun Nesa Alo & Sakhawat Prince 03 January, 2023

ডলার সংকট ও উচ্চ সুদের চাপে ১৪ বিলিয়ন ডলার বিদেশি ঋণ

ইসমাইল আলী, 5 Jan 2023

আদানির বিদ্যুৎ উৎপাদনে ব্যয় হবে সবচেয়ে বেশি, মাসে ক্যাপাসিটি চার্জ গুনতে হবে ১৫ কোটি ডলার, আদানির বিদ্যুৎকেন্দ্রে মাসে গচ্চা যাবে ৭০০ কোটি টাকা!, বিদ্যুৎ কিনলে মাসে গুনতে হবে ৬৭ কোটি ডলার

ইসমাইল আলী, 22-25 Jan 2023

How will Bangladesh pay for massive upcoming power projects this year?

Sharier Khan, 28 Jan 2023

Is the IMF to blame for growing pressure on your wallet?

Abul Kashem, Shakhawat Liton & Titu Datta Gupta

03 February, 2023

Adani saga worries India’s neighbourhood

Suhasini Haidar, 4 Feb 2023

Govt borrowing from commercial banks surges

Tonmoy Modak, 6 Feb 2023

The deep roots of the Adani saga

Syed Akhtar Mahmood, 6 Feb 2023

নিম্নমানের কয়লা কিনেও উচ্চ দাম নিতে পারবে আদানি!

ইসমাইল আলী, 8 Feb 2023

Is Bangladesh’s electricity contract with Adani legally void?

Ravi Nair, 9 Feb 2023

‘আদানি ছাড়া আর কেউ কখনো মামলা করেনি’ and ‘আদানির গোড্ডা চুক্তি বাংলাদেশকে গাড্ডায় ফেলেছে’

পরঞ্জয় গুহ ঠাকুরতা, 11 and 12 Feb 2023

Should Bangladesh Get Out of the Adani Power Deal?

Kamal Ahmed, 16 Feb 2023

Bangladesh Utilities Seek $1 Billion for Fuel to Avert Blackouts

Arun Devnath, 21 Feb 2023

Making interest rate corridor work

Zahid Hussain, 24 February, 2023

বিদ্যুতের অপ্রতিযোগিতামূলক ক্রয় চুক্তিগুলোই কি রাষ্ট্রের সবচেয়ে বড় বোঝা

সাইফুল ইসলাম বাপ্পী ও আবু তাহের, 25 Feb 2023

Adani power purchase against ‘public policy’: How could such a deal be signed?

Asifur Rahman, 28 Feb 2023

Kallol Mustafa, 1 Feb 2023

Is Bangladesh’s admired growth model coming unstuck? and Bangladesh’s economic miracle is in jeopardy

Economist, 1 and 2 Mar 2023

পাল্লা দিয়ে বাড়ছে বিদ্যুৎ উৎপাদন ব্যয় ও দাম

ইসমাইল আলী, 2 Mar 2023

How govt will expand safety net in a time of financial crunch in next budget

02 March, 2023

আদানির সঙ্গে ‘রহস্যজনক’ চুক্তির দায় কার

আসিফ নজরুল, 3 Mar 2023

আদানির অর্ধেক দামে ভারত থেকে বিদ্যুৎ আমদানি সম্ভব

আবু তাহের, 7 Mar 2023

Faisal Mahmud, 9 Mar 2023

Saifuddin Saif, 9 Mar 2023

Kamran Siddiqui, 14 Mar 2023

ডয়েচে ভ্যালির টকশোতে মোহাম্মাদ এ আরাফাতের প্রশ্ন গুলোর উত্তর

Zia Hassan, 19 Mar 2023

Economists recommend wealth tax, financial sector reforms in FY24 budget

Abul Kashem, 19 Mar 2023

IMF also stands for the Impossible Mission Force