For a few billion dollars more

Could it be that foreign residents are no longer so sure about Bangladesh's economic prospects?

The US dollar tends to appreciate during global economic or political turmoil as investors seek the safety of dollar-denominated assets and sell other currencies to acquire the greenback. The war in Ukraine is no exception. The US currency appreciated by around 8 percent against a basket consisting of a broad swath of currencies since Russia invaded Ukraine.

In addition to the geopolitical uncertainties, the war aggravated the inflationary pressures already building around the world, leaving the US Federal Reserve (and other central bankers) little choice but to raise interest rates. Emerging and developing countries' currencies usually depreciate when interest rates rise in advanced economies. Countries with weaker macroeconomic fundamentals tend to be hit with larger depreciations. For example, the Sri Lankan rupee had depreciated by as much as 80 percent and the Pakistan rupee by 36 percent between February and July before regaining some value in more recent weeks.

These are shown in Chart 1, which also shows taka's depreciation (or the dollar's appreciation against the Bangladeshi currency) since 23 February. Going by the official exchange rate, the taka had depreciated by around 11 percent in this period. However, the maximum depreciation, using the media reported 120 taka per dollar reached in the kerb market in mid-July, had been nearly 40 percent.

Latest data point is 3 Sep 2022. The 'maximum' depreciation of the taka is calculated by using the kerb market rate of 120 taka per dollar reported in the media in mid-July.

Of course, Sri Lanka has been experiencing a debilitating economic and political crisis. Pakistan has also been on the precipice of a potential crisis. Bangladesh's fundamentals might be better than Pakistan's. But the taka appears to have been hit harder than the Pakistani rupee in recent months.

It is important to stress the 'might be' and 'appears to' in the above paragraph. Unlike most other currencies, including those of our crisis-hit neighbours, Bangladeshi economic statistics are so opaque that even a simple question like by how much the currency has depreciated does not have a straightforward answer. And this lack of transparency could well cause significant problems.

But we are getting ahead of the story. Let's start with the longer-term determinants of the demand and supply of a country's currency.

Suppose a country has experienced strong economic growth in recent years, and the prospects are bright in the medium term. This country might be ripe for an investment boom, but suppose it's a capital-poor developing country. However, let's also further suppose that savings are rising in this country (perhaps it receives remittances from abroad, a portion of which is saved). Increases notwithstanding, savings in this country might not be sufficient to meet its investment needs. Nonetheless, if foreign residents find the country sufficiently attractive, the country can invest more than it saves by availing foreign funds.

Now suppose there is another country that has had lacklustre growth in recent years and the prospects are bleak, where investment opportunities are meagre, but savings are even more so.

As a matter of balance of payments accounting, which records a country's transactions with the rest of the world over a period of time, the excess investment relative to savings in both countries are reflected in current account deficits. In the first country, foreign residents might be willing to finance the additional investment owing to its stronger fundamentals, but foreign funds might not be so readily available in the second country. If the current account deficit persists in the second country (or the deficit widens suddenly), its residents might need to pay more of its currency to acquire each unit of foreign currency —that is, its currency is likely to depreciate.

That is, faced with a persistent and/or widening current account deficit, a country might face depreciation pressures when savings are low, and investment outlook is grim.

Bangladesh has been running a current account deficit since 2017. Further, back in April (that is, weeks before the depreciation of the taka), the IMF projected a widening of the deficit in 2022.

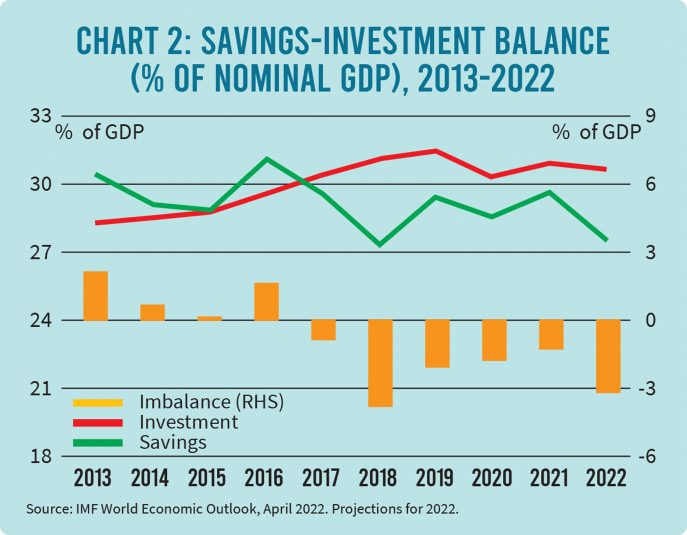

That is, as Chart 2 shows, Bangladesh has been reliant on foreign funds to finance its rising investment needs for a few years. While the savings rate has dipped, it remains relatively high (for example, in Pakistan, savings have been 12-15 percent of GDP in recent years, compared with 27-30 percent in Bangladesh). With strong economic growth outcomes and prospects, foreign residents had been financing the excess investment at existing exchange rates.

Until recently, that is. Could it be that foreign residents are no longer so sure about Bangladesh's economic prospects?

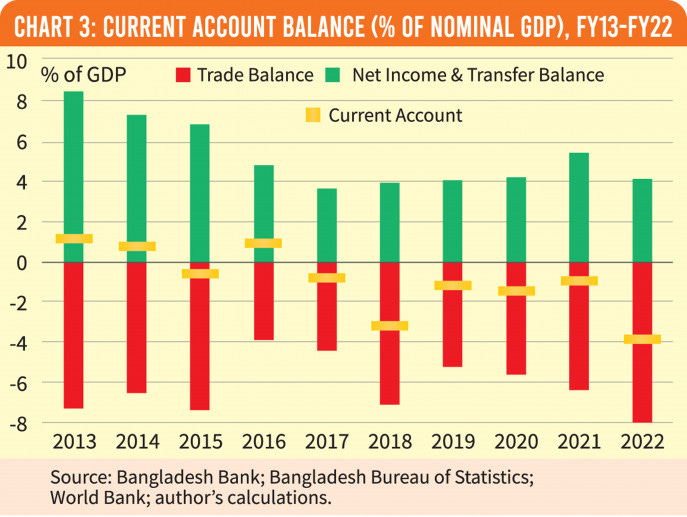

Of course, we can also analyse the current account deficit and its subcomponents — the trade balance, and the net income and transfer balance.

The trade balance records the difference between a country's exports (which garners foreign currency) and imports (which require foreign currency). As Chart 3 shows, Bangladesh has been running a trade deficit over the past decade. The chart also shows that this deficit is partly offset by a net inflow of income (such as interest and dividend) and transfer (such as foreign aid, and crucially for Bangladesh, remittances). The current account deficit widened in 2021-22 financial year, not because the net inflow of income and transfer was unusual, but because of a widening in the trade deficit.

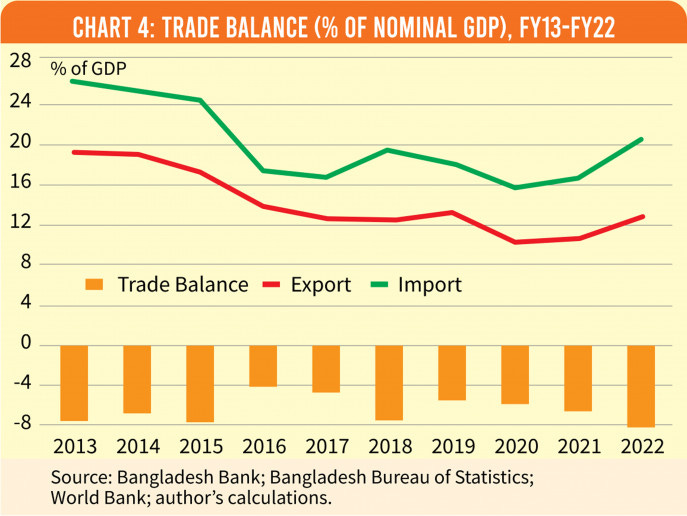

Chart 4 delves into the trade deficit, showing that it's the rise in imports that has driven the widening of the trade deficit, and thus also the current account deficit. Imports rose by 3.9 percent of GDP in 2021-22 compared with the previous year. Although exports also rose relative to GDP, it wasn't enough to prevent a 1.6 percent of GDP widening in the trade deficit.

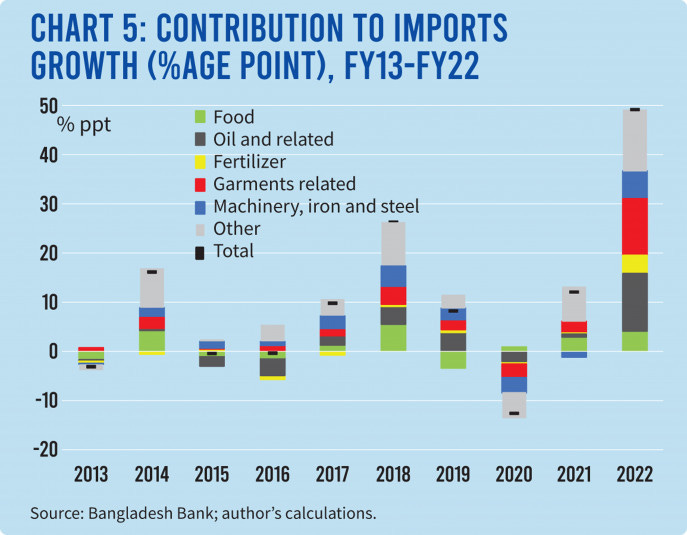

Expressed differently, imports grew by a whopping 49 percent in 2021-22. Chart 5 shows that this galloping figure was broad-based, with oil and garments related imports contributing most to the ballooning imports payments. Import bill on petroleum and related products doubled in 2021-22, adding over 12 percentage points to total imports growth. This clearly reflects the effect of the Ukraine War and related turbulence in the global energy market.

More interesting is the nearly 12 percentage points contribution from garments-related imports —cotton, yarn, fibre and such like. These items are the inputs into the production of readymade garments that make up most of the country's exports. As Chart 6 shows, growth in the import of these items is usually correlated with the growth in exports. In 2021-22, imports of these items grew by 57 percent, while total exports grew by a solid 35 percent. The post-pandemic adjustments in the inventory, supply chain, input and output prices, and the broader production process in the garments industry could explain the inputs growing faster than output in the sector. Further, at least some of the imported inputs may add to exports in the 2022-23 financial year.

That is, the sharp rise in imports bill and thus the widening of the trade deficit might be less alarming upon inspection than appears initially. The widening current account deficit might also be less worrying than it seems.

While the trade deficit widened by 1.6 percent of GDP in 2021-22, the current account deficit widened by 2.9 percent of the GDP. The difference between the two reflects a decline in the net inflow of income and transfer in 2021-22. However, the net income and transfer inflows were elevated in 2020-21 because of the unusually high remittances flow during the pandemic-induced travel bans, which affected the informal hundi channels. As this effect unwound in the 2021-2022, the net income and transfer inflow reverted towards the historical norm.

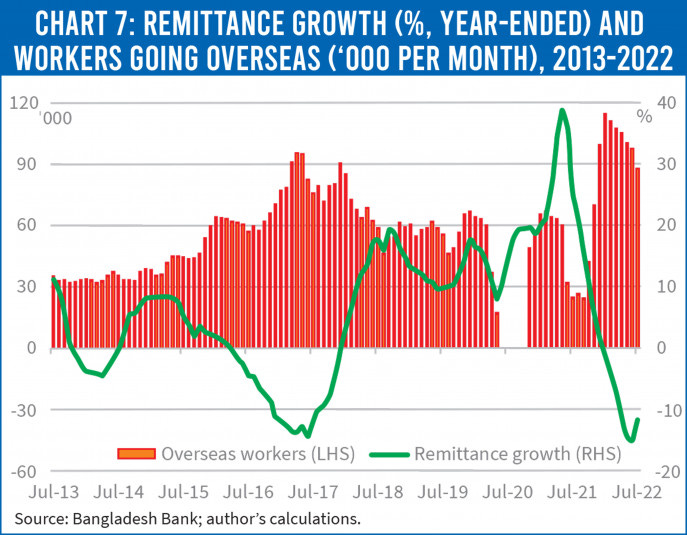

Remittances continue to be volatile, but the number of workers going abroad have been historically high in recent months (Chart 7). With low unemployment and rising wages in the countries receiving Bangladeshi workers, remittance growth may have bottomed.

Remittances are 12-month moving averages; number of workers are 3-month moving averages.

Let's put all of these together. In 2021-22, particularly towards the end of the financial year, import bills blew out, driven partly by high oil prices and the flow-on effects. Further, there was also a sharp rise in the imports of goods that are inputs in the garments sector. Exports proceeds also grew strongly, but not enough to pay for the rising imports. This means, all else equal, an excess demand for foreign currency —that is, a shortage of dollar at the prevailing exchange rate.

Of course, all else is not going to remain equal. As the central banks in the advanced economy hikes interest rate to snuffle out inflation, the global economy is likely to slow. On the one hand, this may reduce oil prices and thus import bills. On the other hand, it may also dampen export earnings and remittances. The net effect of all of that on the demand for foreign currency is not self-evident. That is, if the figures presented in the above charts are to be believed, there may be reasons for being alarmed, but there is no clear reason to panic.

If they are to be believed, the above charts do not portend a 40% depreciation!

Could the issue be around the financing of the current account deficit?

In theory, a current account deficit could be financed at the existing exchange rate by a combination of inflow of foreign investment, borrowing from abroad, and the central bank depleting its foreign reserves to facilitate foreign currency payments.

In its latest country report, published in March based on 2021 analysis, the IMF projected current account deficits of about 2.4-2.6 percent of GDP a year into the medium term. About half of the annual deficit was projected to be financed by the government taking on additional medium-to-long term foreign debt. The rest of the financing was projected to come from private sector borrowing from abroad, foreign investment, and drawing down of reserves (which were expected to cover five months of imports at the end of the projection horizon —anything above three is considered safe).

The current account deficit has clearly proved to be wider than previously envisaged. Is there any reason to believe that the additional financing, worth perhaps half a percent of the GDP or a few billion dollars, would be difficult to avail?

'Only when the tide goes out that do you discover who's been swimming naked', the American businessman Warren Buffett is supposed to have said. As the global monetary and financial conditions tighten, emerging and developing countries are coming under greater scrutiny. If Bangladesh's economic growth fundamentals are to be believed, then it shouldn't be too difficult to find a few billion dollars more to finance the current account deficit.

However, if the credibility of the country's economic prospects comes into question, then foreign residents may not be willing to provide the said few billions.

The country's economic credibility is hurt when there are concerns that the public debt might be underestimated, or when the authorities are intransigent in reporting foreign reserves in the internationally standard manner, or when the authorities fail to explain the rationale for energy subsidies or interest rates or exchange rate policies, or when the finance minister gives a false account of whether the country is seeking an IMF loan —the taka experienced the worst volatility in the days in July when the finance minister gave conflicting account of the country's public finances!

By all accounts, Bangladesh has had a three decades-long run of solid economic development. The powers-that-be have, of course, benefited politically from this performance. But in doing so, they have also gilded the water lily —hiding the bad news here, accentuating the good news there, you get the drift. If the economy is now under threat, it might just be because the country's numbers are no longer taken at face value.

First published at the Business Standard. The title refers to the middle film of Sergio Leone’s Dollars Trilogy.

Further readings

Foreign debt, international reserves, capital flow management

War loans, swap lines and Chinese highways: a history of official lending

When private money flees, the official sector steps in. But the characteristics of this facet of foreign lending have changed vastly since 1790. — Claire Jones 17 Jun 2020

China, Russia and the race to a post-dollar world

Financial markets are going to become a major field of battle — a place to defend liberal values and renew old alliances — Rana Faroohar, 28 Feb 2022

Why the IMF is Updating its View on Capital Flows

In some circumstances, countries should have the option of pre-emptively curbing debt inflows to safeguard macroeconomic and financial stability — Tobias Adrian, Gita Gopinath, Pierre-Olivier Gourinchas, Ceyla Pazarbasioglu, and Rhoda Weeks-Brown, 30 Mar 2022

King Dollar is in no danger of losing its world financial crown

Neither the renminbi nor cryptocurrencies pose a serious threat to the greenback’s supremacy — Megan Greene, 12 Apr 2022

What one BRI project shows us about China’s investment in Bangladesh

The days of multi-billion-dollar BRI investments from China are very likely over. The bureaucratic delays and funding cuts that hamstrung the Establishing Digital Connectivity project help show why. — Adam Pitman, 27 Jun 2022

Despite all economic and political turmoil in the United States, the greenback has appreciated to its strongest level in two decades as global investors have once again chosen it as their safe haven. — Jim O’Neill 11 Jul 2022

A weak starting point, rising interest rates and safe-haven status have made for a huge rally — Economist, 20 Jul 2022

Dollar-euro parity may be justified. But the yen looks cheap as chips

How to use economic theory to value currencies — Economist, 21 Jul 2022

Bangladesh’s finance minister warns on Belt and Road loans from China

Beijing’s poor lending decisions risk pushing developing nations into debt distress, says Kamal — Benjamin Parkin, 9 Aug 2022

Letter: Why Bangladesh minister is phlegmatic on BRI loans

From Gazi Towhidul Islam, Public Relations Officer, Ministry of Finance, Government of the People’s Republic of Bangladesh, Dhaka, Bangladesh

12 Aug 2022

The dollar system’s resilience

…it is not by accident that 90 percent of global forex transactions - $6 trillion per day! - include the dollar as one currency in the pair — Adam Tooze, 13 Aug 2022

A fork in the road for development financing

The moment is quickly approaching when the world will have to decide between two futures for development finance —Daniel Cohen and Ishac Diwan, 22 Aug 2022

Yuan gains while dollar shrinks in Bangladesh reserve

With China emerging as a major economic power, being the second largest economy after the United States, it has become a country of tremendous influence in the global economy and financial markets —Jebun Nesa Alo, 5 Sep 2022

Bangladesh’s economic conditions and outlook

The dollar crisis and the bitter pill Bangladesh must swallow

This is the second of a three-part commentary on the recent developments of the country's economy… deals with exchange rate management — Forrest Cookson, 23 May 2022

Bangladesh’s economic crisis: How did we get here?

Bangladesh’s pathway to the current economic crisis…. was paved by the economic policies of the Hasina government and an unaccountable system of governance of the past decade— Ali Riaz, 5 Aug 2022

The debate is more about how, than whether, to manage the exchange rate — Zahid Hussain, 8 Aug 2022

Truths, damn truths and statistics

When used properly, statistics can indeed bring us closer to the truth — Syed Akhter Mahmood, 15 Aug 2022

This is how people are choked with rising cost of living

Fixed income families are cutting back on meat, fish and eggs and are planning to spend less on health and education to stay within budget —Titu Datta Gupta and Abbas Uddin Noyon, 16 Aug 2022

The curious case of RMG import growth overtaking export’s

The country's imports meant for manufacturing its readymade garments show an unexplained trend if compared with apparel exports —Jebun Nesa Alo & Jasim Uddin, 18 Aug 2022

Why Sri Lanka’s collapse looms large over Bangladesh

It’s the politics, stupid. A cocktail of dynastic rule, cronyism and debt-fueled vanity projects, to be precise — Shafquat Rabbee, 25 Aug 2022

Exporters in raw material crunch

Export-oriented businesses now fear that they might miss shipment deadlines as their sourcing of necessary raw materials are now facing disruptions as some banks are refusing to open LCs on account of dollar shortages —Jasim Uddin, 13 Sep 2022