While the word 'crisis' is frequently used in the media to describe economic difficulties, among practitioners, 'economic crisis' usually means when a government must adjust macroeconomic policy settings suddenly and involuntarily, often with painful consequences such as high inflation.

A crisis is usually not projected, because if one were known to strike, then presumably the policymakers would adjust policy settings pre-emptively.

Developing countries like Bangladesh are often roiled by economic turmoils, some of which go on to become full-blown crises. In some cases, the government cannot mobilise sufficient tax revenue to pay its bills and resort to borrowing.

As credit flows to the government, private sector borrowing withers, which slows investment, employment and household income, which in turn reduces government revenue — and there is a vicious cycle.

At some point, with borrowers refusing to lend further, the government starts printing money. With more cash in the economy relative to goods and services, prices rise and the currency loses its value.

In the extreme, there is hyperinflation. Often, this end is expected by banks, households, and foreigners alike, and the currency depreciates well before the fiscal pressures reach a boiling point. Depreciation, in turn, can fuel inflation by making imported goods more expensive.

Depreciation of a currency could, of course, happen even if a country has solid public finances. If a country has a persistent current account deficit —it cannot earn enough foreign currency from exports and remittances to pay for imports and service its foreign debt obligations — then its currency would face depreciation pressures.

If a country is a net importer of food or energy, the government would face political pressures to spend on cost-of-living support for households hit by inflation. More costly energy imports would also hit production, employment, and incomes —all reducing government tax revenue. The result would be a worsening of the public finances.

Developing countries often try to avoid the depreciation of their currencies because of a fear of inflation. To defend the exchange rate, they build up a stock of foreign currency reserves. If the private sector fears that there might not be sufficient reserves, this itself can set off depreciation pressure, leading to inflation and a hit on the public finances.

Banks and the corporate sectors might also trigger turmoil. Often, poorly regulated banks lend to politically connected businesses for less-than-sound projects. At some point, these bad loans need to be cleaned up. Even an orderly clean-up of the banking sector might hurt the public finances by reducing tax revenue or increasing government debt because of bank bailouts. A disorderly adjustment could lead to bank failures and credit crunch.

Of course, even when the initial conditions are benign —banks are well regulated, there is sufficient foreign exchange reserve, and the government has no problem paying its bills—developing countries can get unlucky with natural disasters, foreign wars, or political problems.

Many of the above factors are at play in Bangladesh currently. Its import bills swelled last year because of the Ukraine war. The currency depreciated. Inflation soared to its highest rate in 12 years. All of these in a country where the banks were in a perilous state, the budget deficit was widening, and the current account swerved into a deficit even before the pandemic.

Is Bangladesh in an economic crisis or about to face one?

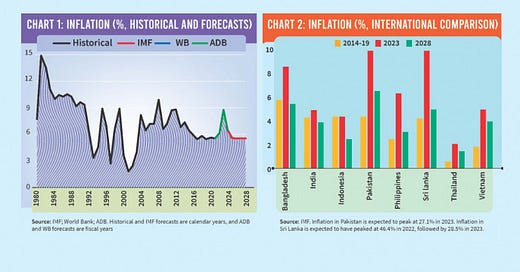

A typical feature of the economic crisis in developing countries is runaway inflation. For example, prices are expected to double in Sri Lanka between 2021 and 2024 and in Pakistan between 2020 and 2025. One can cite similar figures for Turkey or Argentina, let alone Zimbabwe and Venezuela. Nothing like that is expected in Bangladesh. According to the IMF, the World Bank and the Asian Development projections, the current inflationary episode is neither the most severe by historical standards nor is it likely to linger (Chart 1).

Multilateral institutions expect inflation is expected to moderate not just in Bangladesh, but also across the region and indeed globally except in specific countries with idiosyncratic issues. However, parsing through the numbers reveals a few patterns that might not be much appreciated. First, Bangladesh experienced higher inflation than its neighbours before the pandemic (the yellow columns in Chart 2). Second, Bangladesh is experiencing higher inflation than its neighbours bar the crisis-hit Pakistan and Sri Lanka (the red column in Chart 2). Third, when the current episode passes, Bangladesh is projected to be left with a higher rate of price rises than most others in Monsoon Asia (the green column in Chart 2).

A simple reading of the data is that Bangladeshis face higher inflation than their neighbours even in 'normal' times because of its macroeconomic management. And during unusual times of global shocks such as that caused by the Ukraine war, it is hit harder than might have been the case if it had better macroeconomic policy settings, to begin with.

Of course, it is now well recognised that the Bangladesh economy was buffeted by the Ukraine war, which raised the cost of imported oil significantly in the first half of 2022, widening the current account deficit.

With inflation already relatively high —albeit far from anything that might be considered a crisis—the authorities tried, unsuccessfully, to avoid further depreciation by resorting to an eclectic range of measures until the IMF program prescribed conventional policy measures of a gradual rise in interest rates and depreciation of the currency.

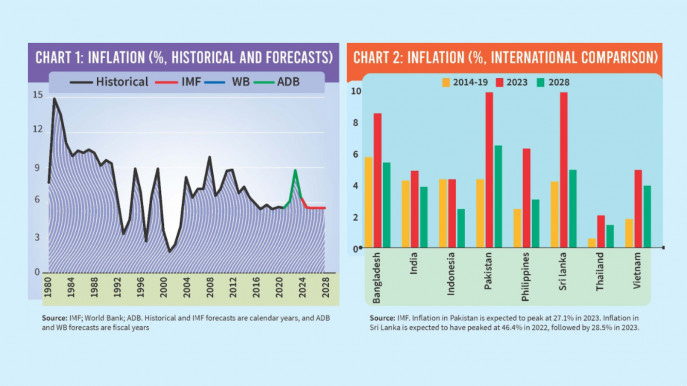

The IMF program comes with a quantitative benchmark of the stock of reserves. As such, there is a lot of attention to the near-term movements in exports, imports, remittances, and foreign debt payments to calculate and project reserves. What is missing from the public discourse is that the IMF's medium-term projections are that even if its program is fully implemented, the current account will still be in deficit into 2028.

In fact, if the IMF projections come to pass, Bangladesh's current account deficit will be wider-for-longer by historical standards (Chart 3).

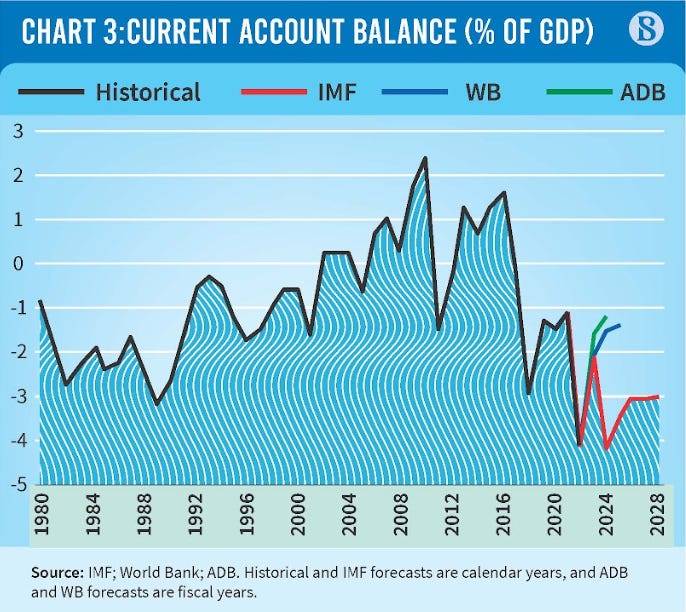

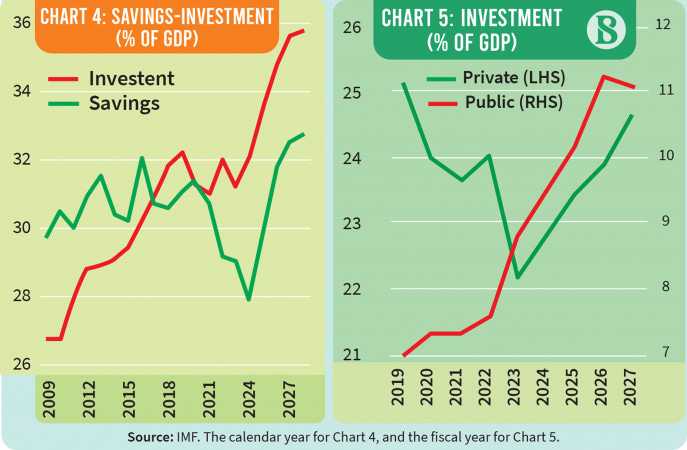

The current account can also be thought of as a measure of whether a country's national savings is sufficient to meet its investment needs, a deficit signifying that investments need to be partially financed by foreign residents. Chart 4 shows savings and investment trends in the recent past as well as the IMF's projections. While savings dipped in the wake of the pandemic and then the Ukraine war, it is expected to recover by the end of the projection period. In contrast, investment seems to have a clear upward trajectory with a pause after the pandemic.

That is, according to the IMF, the worsening current account deficit reflects not insufficient savings by Bangladeshis but more investment projects that need financing. Chart 5 decomposes recent investment trends and projections into the public and private sectors. The private sector investment profile follows that of savings —a dip in the wake of the pandemic and then recovery by the end of the projection horizon. Public investment, on the other hand, is projected to rise by 4% of GDP between 2019 and 2027, accounting for most of the current account deficit.

These savings-investment patterns also explain the IMF's projections for economic growth (Chart 6 - note the typo in the infographics, it should be real GDP growth not inflation). The economy is expected to slow but still grow by a relatively solid clip in 2023 before staging a healthy recovery into the medium term. Underpinning the resilience in 2023 is the dip in national savings —essentially, the households are consuming domestic goods and services by drawing down their savings. Driving the expected recovery are the public investment projects that are still in the pipeline.

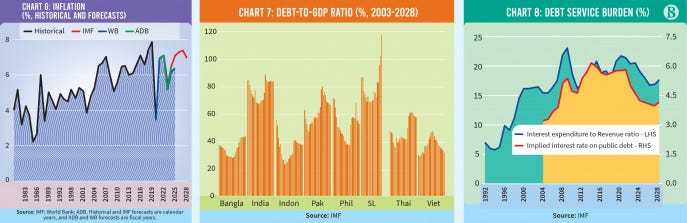

Further, the projected public investment boom is not expected to come with a rising debt-to-GDP ratio. Public debt has risen by nearly 10% of GDP in the wake of the pandemic but is expected to remain stable and lower than in neighbouring countries (Chart 7).

In addition, the burden of servicing the debt is also expected to ease (Chart 8). The share of revenue required to meet interest expenditures is expected to decline, which partly reflects a reduction in the implied interest rate on public debt that comes with bilateral and multilateral concessional lending and a move away from the reliance on the National Savings Certificates.

Okay, let's put all of that together.

According to the multilateral agencies that monitor the economy, the Bangladesh government is expected to continue with its recent infrastructure-investment-driven growth model. Further, these multilateral institutions and their rich world financiers seem to have backed these judgments with actual dollars and yens.

There has been a lot of commentary about the prime minister’s failure to secure any formal meeting in the United States and the United Kingdom during her recent trip. Less noticed has been the fact that her advisor Salman F Rahman (and not the finance minister, who didn’t join the travelling party) did indeed lead Bangladesh in a number of officials-level meetings. In light of the above economic outlook, Mr Rahman may well be the most important person in the country over the coming years.

Finally, the megaprojects-driven economy is expected to have comparatively high inflation and a persistent current account deficit. Neither necessitates a crisis by any means. But both leave the economy vulnerable to adverse shocks and policy mistakes as the country careens towards the election and beyond.

A slightly different version was published in The Business Standard. I am grateful for their graphics team for the fantastic charts.

Further reading

Its political system apparently gives it little reason to invest for the future.

Noah Smith, 25 June 2021

Riding the Global Debt Rollercoaster

The weaker growth outlook and tighter monetary policy call for prudence in managing debt and conducting fiscal policy

Vitor Gaspar, Paulo Medas, Roberto Perrelli

December 12, 2022

Finance and the polycrisis (6): Africa's debt crisis

Adam Tooze, 20 Dec 2022

We must tackle the looming global debt crisis before it’s too late

A range of factors have made the cost of borrowing prohibitive for poor countries

Martin Wolf, 18 Jan 2023

The world lacks an effective global system to deal with debt

Unstable balance sheets are a threat to our collective financial stability

Rebeca Grynspan, 2 Feb 2023

Scandal at South Africa’s Eskom: the CEO and the cyanide-laced coffee

The attempted poisoning of André de Ruyter is a dramatic example of how criminality has seeped into the country’s state

David Pilling 2 Mar 2023

Haiti faces ‘hunger emergency’ amid escalating gang violence and surging inflation

Acute hunger is affecting 4.9 million Haitians, according to a UN report, which outlines the increased need for humanitarian aid

Luke Taylor, 25 Mar 2023

Volatile Commodity Prices Reduce Growth and Amplify Swings in Inflation

Resurgent volatility in commodity markets will likely pose economic challenges in coming years even as prices decline

Adil Mohommad, Mehdi Raissi, Kyuho Lee, Chanpheng Fizzarotti

March 28, 2023

How to Tackle Soaring Public Debt

Timely and appropriate fiscal policy adjustments can reduce debt, but countries in distress will need a more comprehensive approach

Adrian Peralta-Alva, Prachi Mishra

April 10, 2023

Global Economic Recovery Endures but the Road Is Getting Rocky

Inflation is slowly falling, but economic growth remains historically low and financial risks have risen

April 11, 2023

The dire outlook for global growth — and for forecasters

The IMF has labelled the slowdown since 2008 ‘predictable’ but experts did not foresee the universal downturn

Chris Giles, 13 April 2023

IMF calls for ‘another Gleneagles moment’ on debt relief and aid

Package similar to 2005 deal needed as struggling African countries suffer severe funding squeeze, says official

Larry Elliott, 14 April 2023

Asia Likely to See Dynamic Economic Growth, but With Policy Challenges

Region would contribute about 70 percent to global growth this year—but still faces challenges from inflation, debt, and financial vulnerabilities

Krishna Srinivasan, Alasdair Scott

April 13, 2023

How Pakistan can join the South Asia growth boom

Murtaza Hussain, 2 May 2023

Why the 2023 banking crisis does not look like 2008, or why one run is not like another.

Adam Tooze, 11 May 2023

An economic success story runs off the rails

Noah Smith, 17 May 2023

The title is inspired by